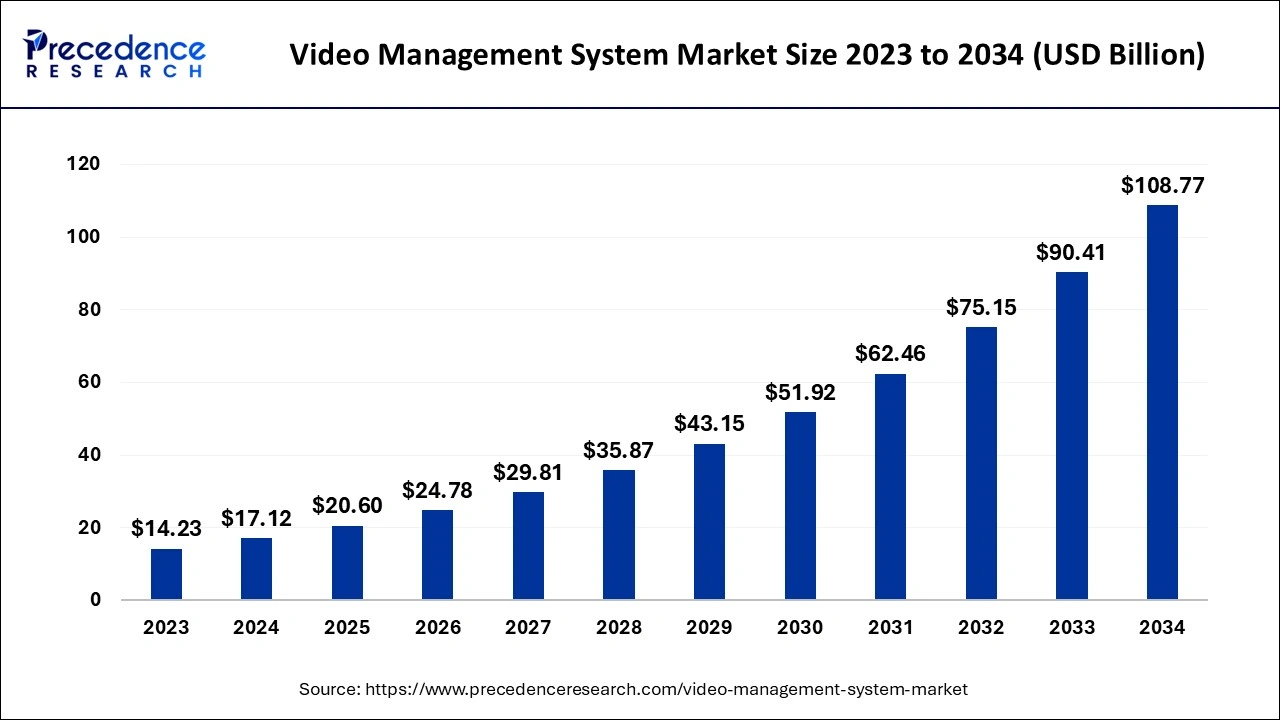

The global video management system market size was evaluated at USD 17.12 billion by 2024 and is projected to gain around USD 108.77 billion by 2034 with a CAGR of 20.31% between 2024 and 2034.

Key Takeaways

- North America dominated the video management system market with the largest market share of 35% in 2023.

- Asia Pacific is expected to grow at a notable CAGR of 24.32% during the forecast period.

- By component, the solution segment accounted for the largest market share of 69% in 2023.

- By component, the services segment is projected to grow at a double digit CAGR over the forecast period.

- By technology, the IP-based segment contributed the biggest market share of 70% in 2023.

- By technology, the analog-based segment will witness considerable growth over the forecast period.

- By mode of deployment, the on-premises segment captured the highest market share of 59% in 2023.

- By mode of deployment, the cloud segment is expected to grow at a notable rate in the market during the studied years.

- By end-user industry, the retail segment held the largest share of the market in 2023.

- By end-user industry, the transportation & logistics segment is expected to grow significantly in the market during the forecast period.

Get Sample Copy of This Report@ https://www.precedenceresearch.com/sample/5114

Market Overview:

The Video Management System (VMS) market refers to the suite of software solutions that manage and store video from a range of sources, including surveillance cameras, mobile devices, and drones. VMS solutions are critical for video monitoring, storage, and analysis across industries such as security, healthcare, retail, and transportation. These systems allow for live streaming, playback, and analysis of recorded video data, helping organizations ensure safety, security, and operational efficiency. The rise of IP-based cameras and advancements in cloud-based technologies have further driven the adoption of VMS, making it a vital tool in modern security infrastructure.

Growth Factors:

The increasing adoption of IP-based surveillance cameras, combined with growing security concerns across the globe, is a major factor driving the growth of the VMS market. Additionally, the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) in video analytics is enhancing the capabilities of video management systems, making them smarter and more efficient. These systems now offer features like facial recognition, behavior analysis, and automatic threat detection, contributing to widespread use in smart cities, public safety, and corporate security. Moreover, the growing trend toward cloud-based solutions, which offer scalability, flexibility, and cost-effectiveness, is significantly boosting market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 108.77 Billion |

| Market Size in 2024 | USD 17.12 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 20.31% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Technology, Mode Of Deployment, End-User Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

One of the key drivers of the VMS market is the escalating demand for enhanced security solutions across both public and private sectors. Governments and enterprises are increasingly investing in video surveillance to protect assets, people, and data from security threats, theft, and vandalism. The expansion of smart cities and public safety initiatives is also pushing the demand for VMS as it helps authorities monitor public areas efficiently. Additionally, regulatory requirements mandating the installation of video surveillance in various industries, such as banking and finance, healthcare, and transportation, are propelling market demand.

Opportunities

The ongoing digital transformation in sectors like retail, transportation, and manufacturing offers significant opportunities for the VMS market. For example, in retail, video management systems are increasingly being used for customer behavior analysis, store layout optimization, and loss prevention.

The advent of smart cities, with integrated systems for traffic management, public safety, and infrastructure monitoring, presents another major growth opportunity for VMS. Furthermore, the growing use of AI-powered analytics in VMS to provide real-time insights and predictive analysis opens up new possibilities for expansion into diverse applications beyond traditional security, such as business intelligence and process optimization.

Challenges

Despite its growth potential, the VMS market faces several challenges. One of the key challenges is the high cost of initial setup and infrastructure, particularly for small and medium-sized enterprises (SMEs). Data privacy concerns also pose a significant hurdle, as the use of video surveillance must comply with stringent data protection regulations such as GDPR in Europe. Another challenge is the complexity of integrating VMS with legacy systems or other security solutions, which can lead to compatibility issues and higher operational costs. Additionally, the market is highly fragmented, with numerous players offering solutions with varying degrees of compatibility and functionality, making it difficult for end-users to choose the right system.

Region Insights

The VMS market is witnessing strong growth across various regions, with North America leading due to its advanced technological infrastructure and high adoption rates of security solutions. The United States is a major contributor, driven by increased security spending in sectors such as defense, transportation, and commercial enterprises. In Europe, countries like the UK, Germany, and France are seeing growth due to heightened concerns over public safety and strict regulatory frameworks.

Meanwhile, the Asia-Pacific region is expected to experience the fastest growth, fueled by rapid urbanization, government initiatives for smart cities, and increased investments in infrastructure development in countries like China, India, and Japan. The Middle East & Africa and Latin America are also gradually embracing VMS, driven by investments in infrastructure and security modernization.

Read Also: At-home Fitness Equipment Market Size to Gain Around USD 20.56 Billion by 2034

Recent Developments

- In April 2022, Qognify announced the launch of its new video management software, Qognify VMS. Qognify VMS is designed to meet the specific physical security needs of organizations around the globe. It is based on the proven technology of Qognify’s successful video management software, Cayuga, which is used by many customers in thousands of security projects worldwide.

- In October 2023, the Karnataka Forest Department, along with the Wildlife Trust of India, launched the Hostile Activity Watch Kernel (HAWK) system, a specialized software platform to monitor all aspects of forest and wildlife crime. The system would help the department manage and monitor data regarding forest and wildlife crime across Karnataka in real-time.

- In June 2023, Cameroon launched video surveillance with live facial recognition in the largest city. An Annex facility of the National Command and Control Centre for Video Surveillance has gone operational in Douala in a move that seeks to counter the spiraling wave of urban insecurity in Cameroon’s largest city, in part through live facial recognition.

Video Management System Markets Top Companies

- Bosch

- Hanwha Techwin

- Honeywell

- Schneider Electric

- Avigilon Corporation

- Backstreet Surveillance

- Axis Communications

- Johnson Controls

- Hikvision Digital

- Axis Communications AB

- Johnson Controls

- Dahua Technology USA Inc

- Verint Systems Inc.

- Mindtree Ltd.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Schneider Electric

- NetApp

- KEDACOM

Segments Covered in the Report

By Component

- Solution

- Services

By Technology

- Analog-Based

- IP-Based

By Mode of Deployment

- On-Premise

- Cloud

By End-user Industry

- Retail

- Airports

- Education

- Banking

- Healthcare

- Transportation & Logistics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/5114

Contact Us:

Mr. Alex

Sales Manager

Call: + 1 804 441 9344

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/

Blog: https://www.dailytechbulletin.com/