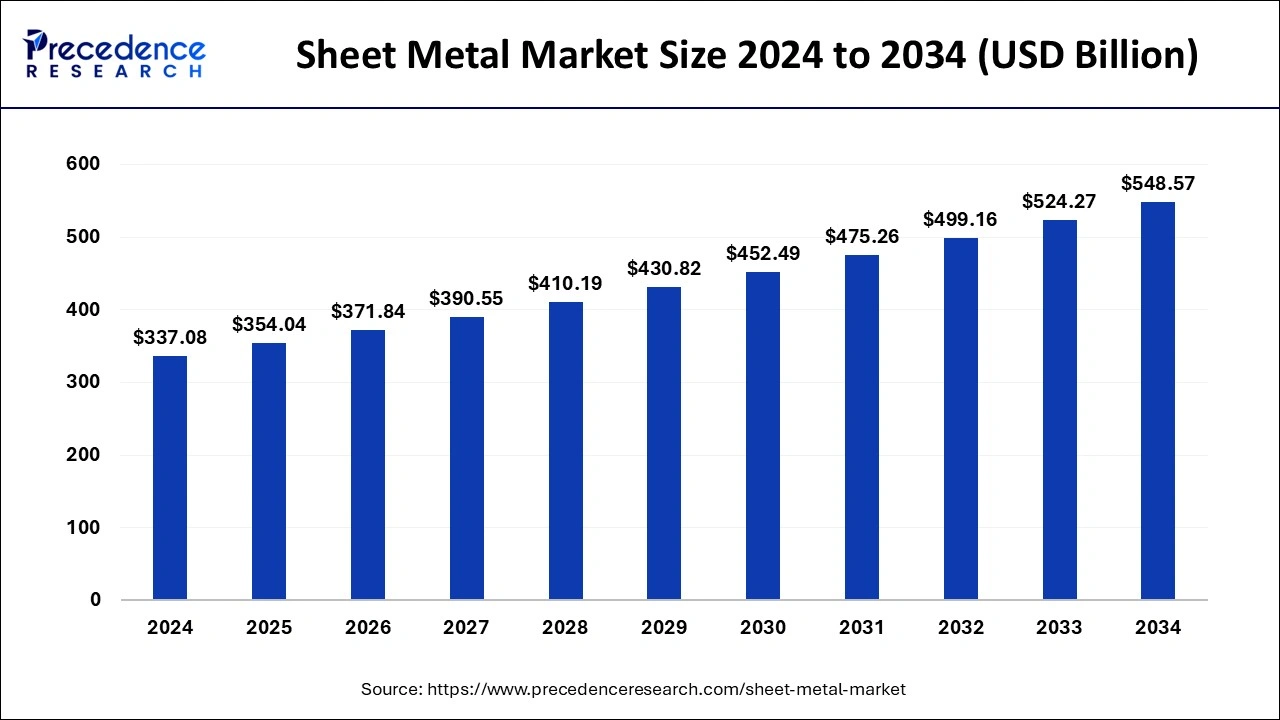

The global sheet metal market size was exhibited at USD 320.94 billion in 2023 and is anticipated to be expanding around USD 524.27 Billion by 2033, growing at a impressive CAGR of 5.03% from 2024 to 2033.

Key Points

- Asia Pacific dominated the market with the largest revenue share of 62% in 2023.

- North America is estimated to expand at a CAGR of 4.8% during the forecast period of 2024-2033.

- By material type, the steel segment has held a major revenue share of 93% in 2023.

- By material type, the aluminum segment is expected to be the fastest-growing during the forecast period.

- By end-use type, the building and construction segment has contributed more than 56% of revenue share in 2023.

- By end-use type, the automotive and transportation segment is anticipated to be the fastest growing during the forecast period.

Market Overview

The sheet metal market encompasses the production and distribution of thin, flat pieces of metal that are fundamental in a variety of industries including automotive, construction, aerospace, and machinery. Sheet metal can be made from a wide range of materials, such as steel, aluminum, brass, and copper, each offering unique properties suitable for specific applications. The market is characterized by its vast applications, from manufacturing car bodies and aircraft panels to home appliances and roofing materials. Innovations in manufacturing techniques and the growing adoption of advanced materials are driving the market’s expansion.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4465

Growth Factors

Several factors are contributing to the growth of the sheet metal market. Firstly, the rising demand from the automotive sector, driven by the global increase in vehicle production and the shift towards lightweight vehicles for better fuel efficiency, is a major growth factor. Secondly, rapid urbanization and industrialization in emerging economies are boosting the construction industry, which in turn increases the demand for sheet metal products. Additionally, advancements in technology, such as the development of high-strength, lightweight alloys and improved fabrication techniques, are enhancing the capabilities and applications of sheet metal, further fueling market growth.

Sheet Metal Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 320.94 Billion |

| Market Size in 2024 | USD 337.08 Billion |

| Market Size by 2033 | USD 524.27 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 5.03% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Material Type, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The primary drivers of the sheet metal market include technological advancements, increasing automotive production, and robust construction activities. Innovations in automation and precision in metal fabrication have significantly increased production efficiency and product quality. The automotive industry’s continuous push towards lightweight and fuel-efficient vehicles has led to increased use of advanced sheet metal materials. Furthermore, the global construction industry’s expansion, driven by urbanization and infrastructure development, has heightened the demand for sheet metal products used in structural components and exterior applications.

Opportunities

Opportunities in the sheet metal market are abundant, particularly with the increasing focus on sustainability and renewable energy. The adoption of electric vehicles (EVs) presents significant opportunities, as these vehicles require lightweight and durable materials. Additionally, the growing trend towards green building practices and energy-efficient buildings can lead to increased demand for sheet metal in roofing, cladding, and HVAC systems. Innovations in recycling technologies also offer opportunities for sustainable production and cost reduction. The expansion of the aerospace sector, with its high demand for lightweight and high-strength materials, further provides lucrative opportunities for market players.

Challenges

Despite its growth potential, the sheet metal market faces several challenges. Fluctuating raw material prices, particularly for metals like steel and aluminum, can affect profit margins and market stability. Additionally, the high initial costs associated with advanced fabrication technologies and machinery can be a barrier for small and medium-sized enterprises (SMEs). The market also contends with stringent environmental regulations regarding emissions and waste management, which can increase operational costs. Moreover, the skilled labor shortage in the metal fabrication industry poses a challenge to maintaining high production standards and meeting growing demand.

Region Insights

Regionally, the sheet metal market exhibits varied dynamics. Asia-Pacific is the largest and fastest-growing market, driven by rapid industrialization, urbanization, and the booming automotive and construction sectors in countries like China and India. North America and Europe also hold significant market shares, with established automotive industries and ongoing investments in infrastructure development. The presence of leading aerospace manufacturers in these regions further boosts market demand. Meanwhile, the Middle East and Africa are witnessing growth due to increasing construction activities and industrialization. Latin America shows moderate growth, supported by developments in the construction and automotive sectors.

Read Also: https://www.businesswebwire.com/chemical-catalyst-market/

Sheet Metal Market Companies

- Constellium

- Kaiser Aluminum

- Alcoa Corporation

- Arconic

- Baosteel Group

- JFE Steel Corporation

- United States Steel

- POSCO

- Nippon Steel Corporation

- Tata Bluescope Steel

- JSW

Recent Developments

- In June 2022, a global leader in industrial metrology solutions, ZEISS, announced the opening of IMTEX 2022, and the flagship exhibition was arranged by IMTMA. The 3- products were launched: COUNTRUA, METROTOM 1, and SURFCOM NEX 200 SD2. They demonstrated a large range of Metrology solutions that help with sheet metal forming.

- In September 2022, a new digital sheet metal forming technology with Figur G15, which has a high-quality surface finish at IMTS, was announced by Desktop Metal. This new technology does not require post-processing like presses, dies, molds, and stamping tools.

Segments Covered in the Report

By Material Type

- Steel

- Aluminum

- Others

By End-Use

- Automotive & Transportation

- Building & Construction

- Industrial Machinery

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/