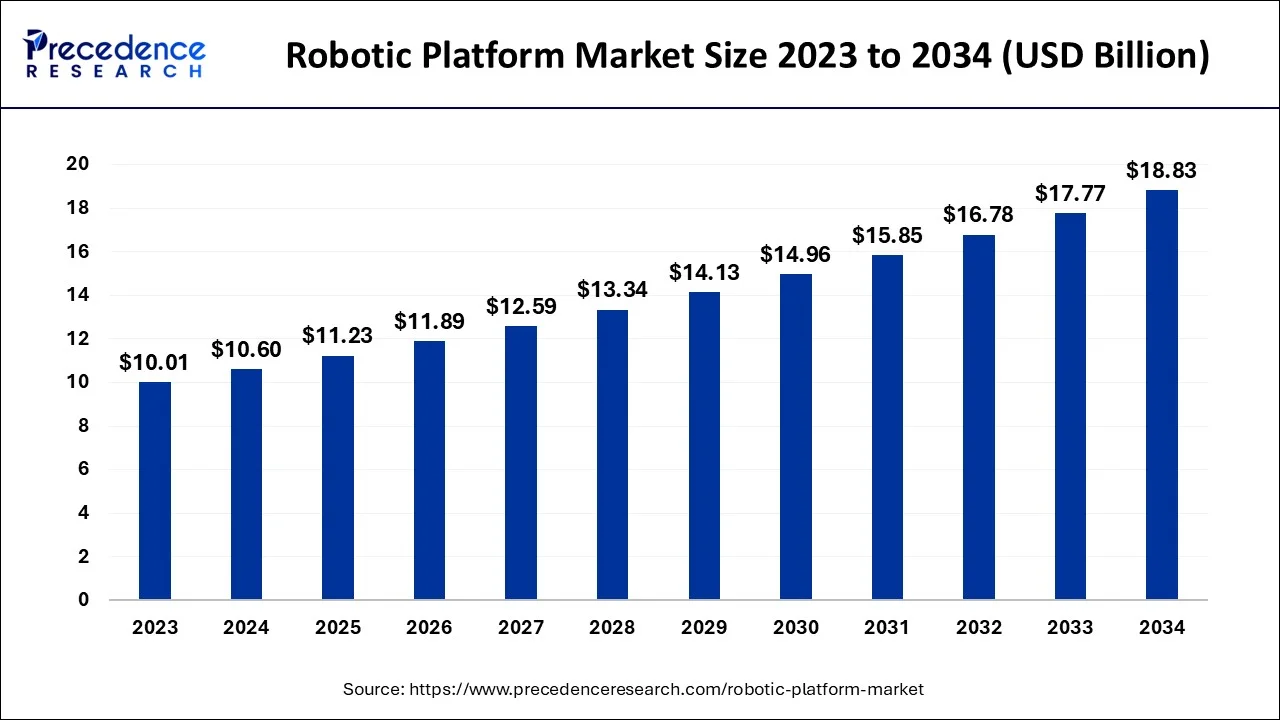

The global robotic platform market size was evaluated at USD 10.60 billion in 2024and is projected to gain around USD 18.83 billion by 2034 with a CAGR of 5.91% between 2024 and 2034.

Key Takeaways

- North America dominated the robotic platform market with the largest market share of 36% in 2023.

- Asia Pacific is expected to grow at a solid CAGR of 8.04% during the forecast period.

- By robot type, the industrial robots segment accounted for the largest market share of 67% in 2023.

- By robot type, the service robots segment is expected to expand at the fastest growth rate during the forecast period.

- By deployment, the on-premises segment dominated the robotic platform market in 2023.

- By deployment, the cloud segment is expected to grow significantly in the coming years.

- By type, the stationary segment led the market with the largest share in 2023.

- By type, the mobile segment is projected to register the fastest growth during the foreseeable period.

- By end-user, the manufacturing segment held the largest share of the market in 2023.

- By end-user, the healthcare segment is expected to expand at a significant pace throughout the forecast period.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/5111

Market Overview

The Robotic Platform Market is experiencing significant growth as robotics are increasingly adopted across various industries such as manufacturing, healthcare, agriculture, logistics, and defense. Robotic platforms are versatile and programmable machines designed to automate repetitive tasks, increase precision, and improve operational efficiency. These platforms include autonomous mobile robots (AMRs), robotic arms, collaborative robots (cobots), and drones, among others. With advancements in artificial intelligence (AI), machine learning (ML), and sensor technologies, robotic platforms are becoming smarter, more adaptable, and easier to integrate into existing workflows, driving their widespread adoption.

Growth Factors

The rapid growth in industrial automation and the increasing demand for efficiency and precision in complex operations are the key factors contributing to the growth of the robotic platform market. Industries like automotive, electronics, and healthcare are embracing robotics to automate tasks that were traditionally labor-intensive, leading to faster production cycles and reduced costs. Additionally, the development of collaborative robots, which can work alongside humans, has opened new avenues in small- and medium-sized enterprises (SMEs) that previously lacked access to automation technologies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 18.83 Billion |

| Market Size in 2024 | USD 10.6 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.91% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Robot Type, Deployment, Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Key drivers of the robotic platform market include the surge in demand for automation across sectors, technological advancements, and the growing need to reduce human error and enhance productivity. Industries such as e-commerce and logistics have witnessed a massive surge in demand for robotic platforms due to the need for faster order fulfillment and warehouse automation. The rising investments in research and development (R&D) for robotics, coupled with government initiatives promoting Industry 4.0 and smart factories, further drive the market’s growth.

Opportunities

The expansion of robotic platforms into emerging sectors like agriculture, healthcare, and retail presents significant opportunities for market growth. In agriculture, robots are increasingly being used for precision farming, harvesting, and soil analysis. In healthcare, robotic platforms assist in surgeries, rehabilitation, and patient care. Furthermore, the development of AI-powered robotic platforms capable of performing complex tasks autonomously offers vast potential for new applications, such as eldercare robots, autonomous delivery systems, and smart city infrastructure.

Challenges

Despite the positive outlook, several challenges hinder the market’s growth. High initial costs of robotic platforms and the need for skilled personnel to operate and maintain these systems can limit adoption, especially for small businesses. Additionally, concerns about job displacement due to automation, data privacy issues, and regulatory constraints in certain regions may slow the widespread implementation of robotic platforms. Technical challenges, such as system integration and ensuring safety in human-robot collaboration, also pose barriers to adoption.

Region Insights

The Asia Pacific region is expected to dominate the robotic platform market, driven by the rapid adoption of industrial robots in manufacturing hubs such as China, Japan, and South Korea. These countries are heavily investing in automation to enhance productivity and maintain their competitive edge in global manufacturing. North America is also a key market, particularly in sectors like healthcare, defense, and logistics, where the use of advanced robotic platforms is growing rapidly. Europe follows closely, with strong adoption in automotive and industrial automation. Meanwhile, emerging markets in Latin America and the Middle East & Africa are witnessing gradual growth as industries in these regions recognize the long-term benefits of automation.

Read Also: Conductive Polymers Market Size to Gain USD 12.74 Billion by 2034

Recent Developments

- In June 2024, ABB unveiled the OmniCore, a next-generation robotics control platform. OmniCore is a progression to a modern and adaptable control system that will open up opportunities for the targeted use of AI, sensor, cloud, and edge technologies to build new, sophisticated, and self-sufficient robotic solutions.

- In May 2023, Robocath launched a new robotic platform, R-One+. This platform allows the interventional cardiologist to perform coronary angioplasties by controlling the devices using an integrated control command unit located in the cath lab or the control room.

- In March 2024, IBM revealed Robotic Process Automation version 23.0.15 with improved functions and solutions. This brings about scheduling and workflow with Time Zone support as well as the use of Federal Information Processing Standards (FIPS) and intelligent User Management Services (UMS) management tools.

- In March 2024, Cognizant and Google Cloud expanded their partnership to enhance software development efficacy by embracing the Gemini platform for Google Cloud.

- In March 2024, Addverb entered into a partnership with DHL Supply Chain in North America. The partnership entails the use of 52 Zippy sorting robots and an Addverb software application in a DHL warehouse in Columbus, Ohio.

Robotic Platform Market Players

- ABB LTD.

- Amazon.com, Inc.

- Clearpath Robotics

- CloudMinds

- Cyberbotics

- Dassault Systemes

- Google LLC

- IBM Corporation

- KEBA

- KUKA AG

- Microsoft

- NVIDIA Corporation

- Rethink Robotics

- Universal Robots

Segments Covered in the Report

By Robot Type

- Service Robots

- Industrial Robots

By Deployment

- Cloud

- On-premises

By Type

- Stationary

- Mobile

By End-user

- Manufacturing

- Electrical & Electronics

- Automotive

- Pharmaceuticals

- Food & Beverages

- Metals & Machinery

- Plastic, Rubber, and Chemicals

- Others

- Logistics and Transportation

- Healthcare

- Retail and e-commerce

- Residential

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/5111

Contact Us:

Mr. Alex

Sales Manager

Call: + 1 804 441 9344

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/