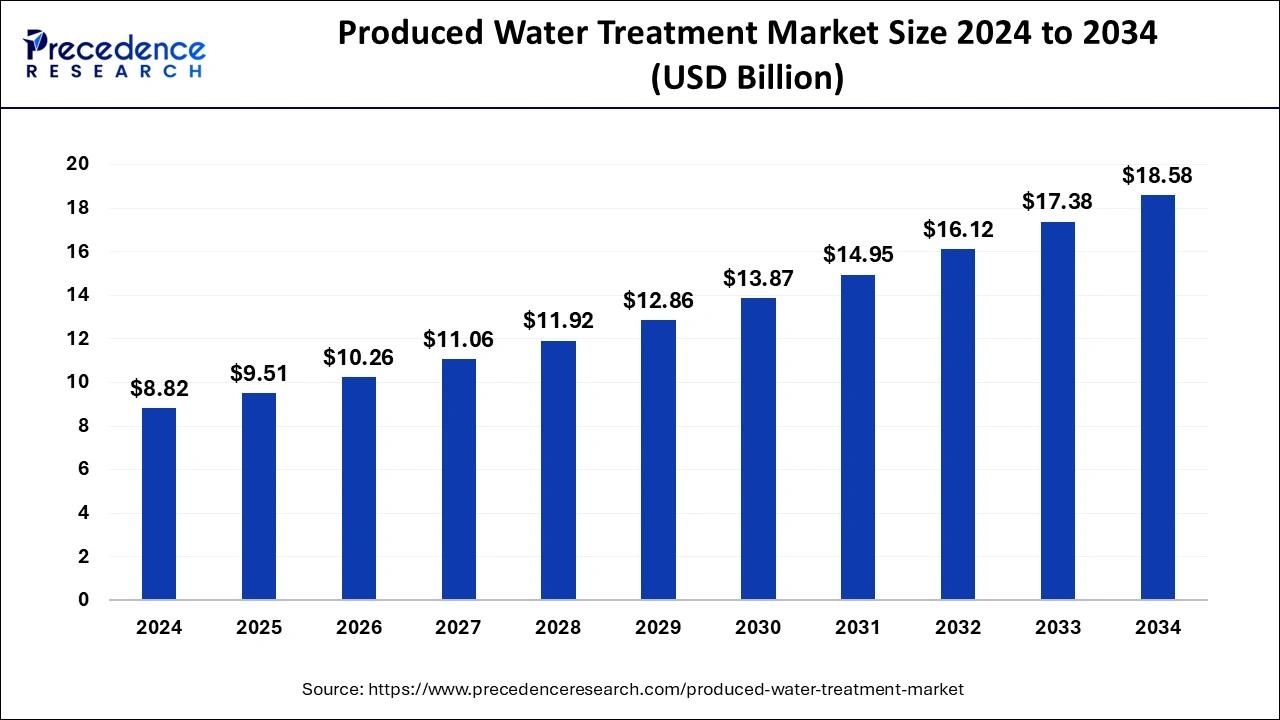

The global produced water treatment market size was evaluated at USD 8.18 billion by 2023 and is projected to gain around USD 17.38 billion by 2033 with a CAGR of 7.83% between 2024 and 2033.

Key Points

- The North America produced water treatment market size is exhibited at USD 3.52 billion in 2023 and is expected to attain around USD 7.56 billion by 2033, poised to grow at a CAGR of 7.94% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 43% in 2023.

- Europe is expected to host the fastest-growing market during the forecast period.

- By application, the on-shore segment has held a major revenue share of 72% in 2023.

- By application, the off-shore segment is expected to witness the fastest growth in the market.

- By treatment, the physical treatment segment has contributed more than 48% of revenue share in 2023.

- By treatment, the chemical treatment segment is expected to expand rapidly in the market during the forecast period.

Market Overview

The produced water treatment market focuses on the treatment and management of water that is a byproduct of oil and gas extraction processes. This market encompasses various technologies and methods used to treat the water, ensuring that it meets regulatory standards for discharge or is suitable for reuse. The treatment processes typically involve the removal of contaminants such as hydrocarbons, salts, heavy metals, and suspended solids. As the oil and gas industry continues to expand, the need for effective produced water treatment solutions becomes increasingly critical to address environmental concerns and operational challenges.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4474

Growth Factors

Several factors contribute to the growth of the produced water treatment market. The primary driver is the increasing global demand for oil and gas, which directly correlates with the volume of produced water. Environmental regulations are becoming more stringent, requiring companies to implement advanced treatment solutions to minimize ecological impact. Additionally, advancements in treatment technologies, such as membrane filtration, advanced oxidation processes, and biological treatments, enhance the efficiency and effectiveness of water treatment, spurring market growth. The rising awareness of water scarcity issues also promotes the recycling and reuse of treated produced water, further driving market expansion.

Produced Water Treatment Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 17.38 Billion |

| Market Size in 2023 | USD 8.18 Billion |

| Market Size in 2024 | USD 8.82 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 7.83% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Application, Treatment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The market is driven by a combination of regulatory, technological, and economic factors. Stringent environmental regulations imposed by governments and international bodies mandate the treatment of produced water to prevent contamination of natural water bodies and soil. Technological advancements have made treatment processes more efficient and cost-effective, encouraging adoption by the oil and gas industry. Moreover, the economic benefits of reusing treated produced water for industrial applications, such as hydraulic fracturing and agricultural irrigation, create a strong incentive for companies to invest in treatment solutions.

Opportunities

The produced water treatment market presents significant opportunities for innovation and expansion. The development of cost-effective and sustainable treatment technologies is a major area of focus, with potential for significant returns. Companies can explore the integration of digital solutions and automation to enhance the efficiency and monitoring of treatment processes. There is also a growing opportunity in the secondary use of treated water, such as in agriculture or industrial processes, which can help mitigate water scarcity issues in arid regions. Additionally, the market holds potential for growth in emerging economies where oil and gas extraction activities are on the rise and environmental regulations are being strengthened.

Challenges

Despite the promising growth prospects, the produced water treatment market faces several challenges. High initial investment costs and operational expenses can deter smaller companies from adopting advanced treatment technologies. The complexity and variability of produced water composition across different extraction sites require tailored treatment solutions, adding to the complexity and cost. Additionally, the disposal of treatment byproducts, such as concentrated brine and sludge, poses environmental and logistical challenges. Ensuring compliance with diverse and evolving environmental regulations across different regions also adds to the operational burden for companies in this market.

Region Insights

The produced water treatment market exhibits varying dynamics across different regions. North America, particularly the United States and Canada, holds a significant share of the market due to extensive oil and gas extraction activities and stringent environmental regulations. The Asia-Pacific region is anticipated to witness substantial growth, driven by increasing energy demand, expanding oil and gas industries, and tightening environmental policies in countries like China and India. The Middle East and Africa also present lucrative opportunities, given the region’s vast oil reserves and the growing emphasis on sustainable water management practices. Europe, with its advanced regulatory framework and focus on environmental sustainability, is expected to maintain steady growth in the produced water treatment market.

Read Also: https://www.businesswebwire.com/gift-packaging-market/

Produced Water Treatment Market Companies

- Godrej Consumer Products Ltd.

- S. C. Johnson & Son

- Dabur India Ltd.

- Reckitt Benckiser.

- Spectrum Brands Holdings Inc.

Recent Developments

- In December 2023, In order to advance as a comprehensive water solution firm in the international market, Samyang Corporation, the pioneer in the development of ion exchange resin in Korea and a leader in the field of industrial water treatment materials, has introduced two new products and formed a specialized organization.

- In February 2023, through its Xylem Innovation Labs commercial accelerator program, multinational water technology corporation Xylem is fostering the growth of up-and-coming startups and expediting the creation of game-changing technologies. The program, which is in its second year, has just accepted ten new businesses.

Segment Covered in the Report

By Application

- Onshore

- Offshore

By Treatment

- Physical Treatment

- Chemical Treatment

- Biological Treatment

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/