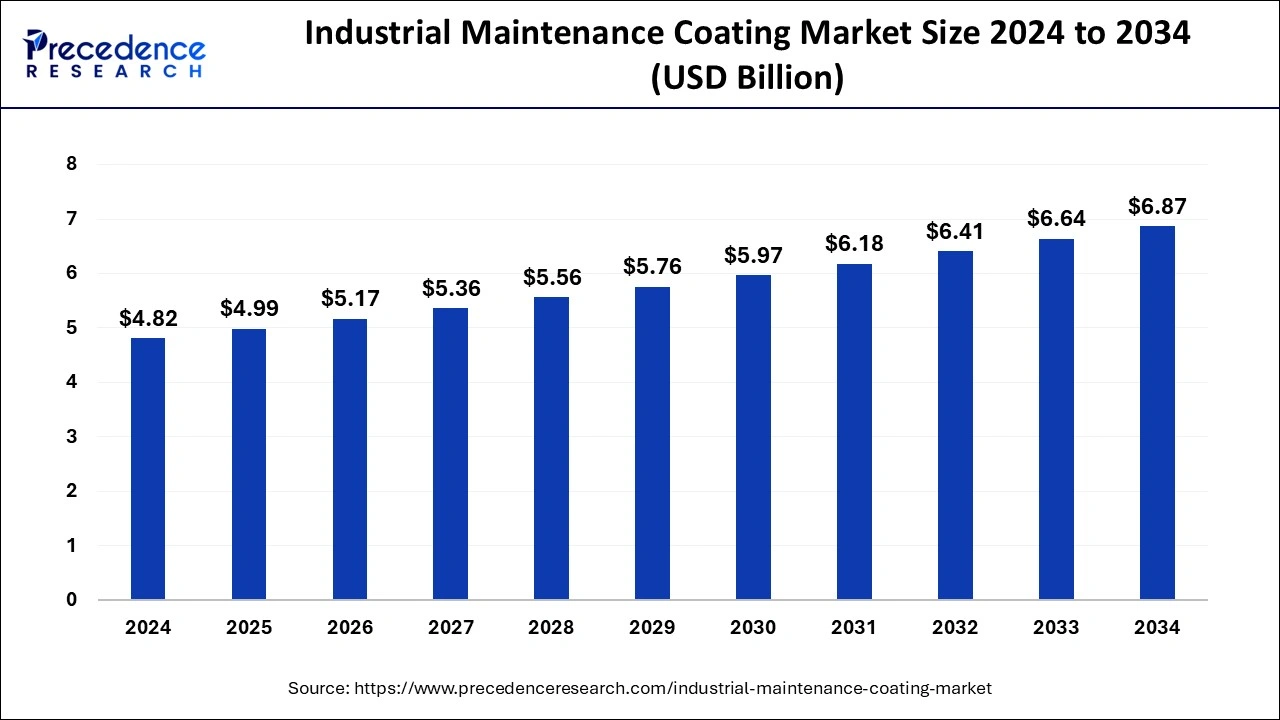

The global industrial maintenance coatings market size was evaluated at USD 4.65 billion by 2023 and is projected to gain around USD 6.64 billion by 2033 with a CAGR of 3.63% between 2024 and 2033.

Key Points

- Asia Pacific dominated the market with the largest revenue share of 45% in 2023.

- North America is expected to grow at the highest CAGR in the market during the forecast period.

- By type, the epoxy coatings segment has held a major revenue share of 35% in 2023.

- By type, the acrylic coatings segment is expected to grow at the highest CAGR in the market during the forecast period.

- By technology, the solvent-borne segment has contributed more than 61% of revenue share in 2023.

- By technology, the waterborne coatings segment is expected to grow at the highest CAGR in the market during the forecast period.

- By end-use industry, the energy & power segment dominated the market in 2023.

- By end-use industry, the metal processing segment is expected to grow at the highest CAGR in the market during the forecast period.

Market Overview

The Industrial Maintenance Coatings Market encompasses a range of products designed to protect and enhance the durability of industrial surfaces. These coatings are crucial in preventing corrosion, chemical damage, and wear and tear in various industries, including oil and gas, manufacturing, and transportation. The market is characterized by a diverse product portfolio, including epoxy, polyurethane, acrylic, and alkyd coatings, each tailored to specific applications and environmental conditions.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4477

Growth Factors

The growth of the Industrial Maintenance Coatings Market is driven by several key factors. The increasing industrialization and urbanization in emerging economies have led to a higher demand for robust protective coatings. Additionally, stringent environmental regulations mandating the use of eco-friendly coatings have spurred innovation and adoption of advanced coating technologies. The rising focus on infrastructure development and maintenance, particularly in sectors such as transportation and energy, further fuels market growth.

Industrial Maintenance Coatings Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 6.64 Billion |

| Market Size in 2023 | USD 4.65 Billion |

| Market Size in 2024 | USD 4.82 Billion |

| Market Growth Rate | CAGR of 3.63% from 2024 to 2033 |

| Largest Market | Asia- Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Technology, End-use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Several drivers propel the Industrial Maintenance Coatings Market forward. The need for enhanced equipment lifespan and reduced maintenance costs encourages industries to invest in high-performance coatings. The growing awareness about the benefits of protective coatings, such as improved safety and efficiency, also contributes to market expansion. Furthermore, advancements in coating technologies, including the development of nanocoatings and smart coatings, offer superior protection and functionality, attracting more end-users.

Opportunities

The Industrial Maintenance Coatings Market presents numerous opportunities for growth and innovation. The increasing emphasis on sustainable and eco-friendly solutions opens avenues for developing low-VOC (volatile organic compounds) and water-based coatings. The rise of Industry 4.0 and the integration of IoT (Internet of Things) in industrial processes offer potential for smart coatings that can provide real-time monitoring and maintenance capabilities. Additionally, expanding industrial activities in regions such as Asia-Pacific and Latin America present lucrative opportunities for market players to establish and grow their presence.

Challenges

Despite the positive outlook, the Industrial Maintenance Coatings Market faces several challenges. The high cost of advanced coatings and the complexity of application processes can deter small and medium-sized enterprises from adopting these solutions. Fluctuations in raw material prices and supply chain disruptions can also impact market dynamics. Moreover, stringent environmental regulations require continuous innovation and compliance, which can be resource-intensive for manufacturers.

Region Insights

Regionally, the Industrial Maintenance Coatings Market exhibits varying trends and growth patterns. North America and Europe are mature markets with a strong focus on advanced and eco-friendly coatings, driven by stringent regulatory standards and a high level of industrial activity. The Asia-Pacific region is expected to witness significant growth due to rapid industrialization, infrastructure development, and increasing foreign investments. In Latin America and the Middle East & Africa, the market is driven by expanding oil and gas industries and the need for robust protective solutions in harsh environmental conditions.

Read Also: https://www.businesswebwire.com/solar-pv-panels-market/

Recent Developments

- In March 2024, Capital Coating, Inc., A company that specializes in commercial and industrial coatings, announced the creation of a new branch that will only handle commercial roof replacement, maintenance, and care.

- In January 2024, Carboline announced the introduction of Carbothane DTM Mastic, a one-coat solution for applications requiring short turnaround times or emergency maintenance. Urethane-based hybrid Carbothane DTM Mastic performs exceptionally well over steel surfaces with little preparation.

- In November 2023, Dover and PSG Biotech, a division of PSG, announced the release of the Quattroflow® QB2-Standard (QB2-SD) Single-Use Precision Micropump. The first micropump in the QB Series, the QB2-SD, has expanded the Quattroflow pump family.

Industrial Maintenance Coatings Market Companies

- AkzoNobel N.V.

- BASF SE

- DuPont de Nemours, Inc

- Hempel A/S

- Jotun AS

- Kansai Paint Company, Ltd

- PPG Industries, Inc.

- Sherwin-Williams Company

- Sika AG

- Sir Industrials Limited

- Valspar Corporation

- Wacker Chemie AG

Segment Covered in the Report

By Type

- Acrylic Coatings

- Alkyd Coatings

- Epoxy Coatings

- Polyurethane Coatings

- Others (such as vinyl, polyester, and ceramic coatings)

By Technology

- Solvent-borne Coatings

- Waterborne Coatings

- Powder Coatings

- UV-cured Coatings

By End-use Industry

- Energy & Power

- Metal Processing

- Transportation

- Chemical processing

- Construction

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/