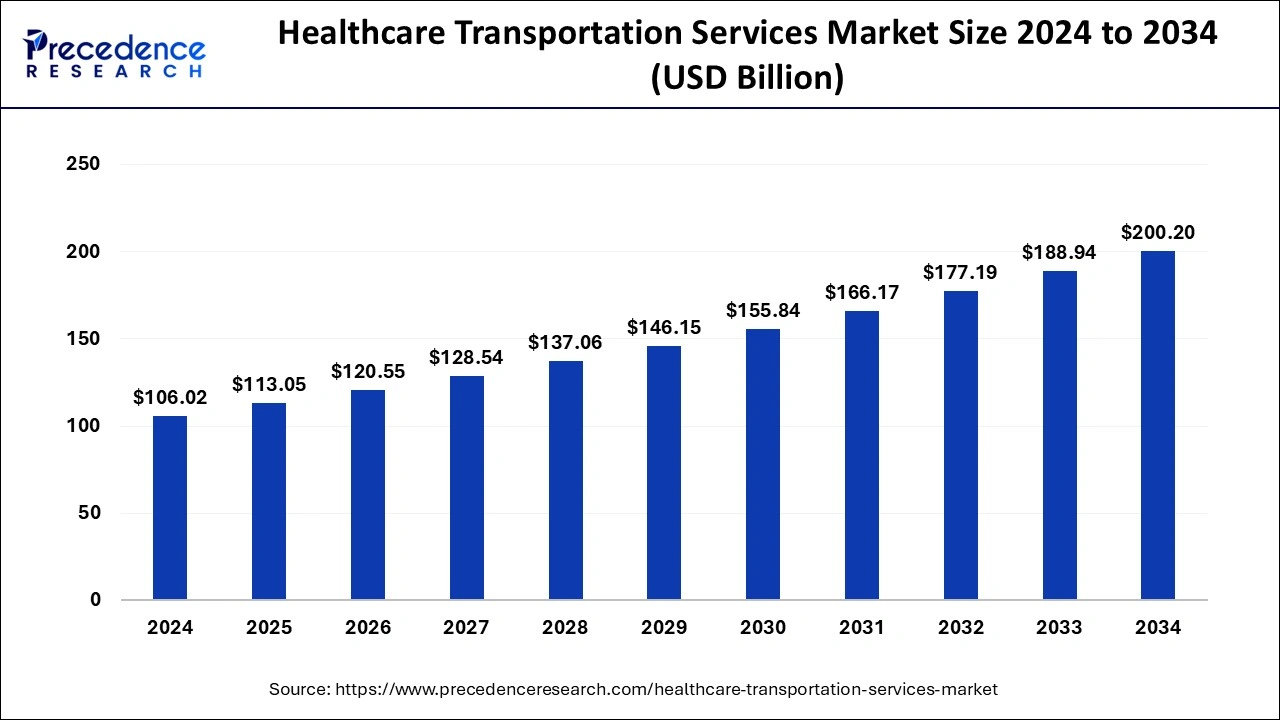

The global healthcare transportation services market size was evaluated at USD 99.4 billion by 2023 and is projected to gain around USD 188.94 billion by 2033 with a CAGR of 6.63% between 2024 and 2033.

Key Points

- North America dominated the healthcare transportation services market in 2023.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By type, the patient transport segment dominated the market with the largest share in 2023.

- By end user, the hospitals segment dominated the market in 2023.

Market Overview

The healthcare transportation services market encompasses a broad range of services dedicated to ensuring timely and safe transport of patients, medical equipment, and supplies. These services are essential for maintaining the continuum of care, facilitating access to healthcare facilities, and supporting the logistics involved in medical emergencies, routine transfers, and specialized treatments. The market includes ambulance services, medical courier services, non-emergency medical transportation (NEMT), and air medical transport, each tailored to specific needs within the healthcare sector.

Growth Factors

Several factors drive the growth of the healthcare transportation services market. Rising healthcare expenditures, increasing elderly population requiring specialized transport, advancements in medical technology necessitating secure and rapid transport of equipment, and the expansion of healthcare infrastructure in developing regions are significant growth drivers. Moreover, the growing prevalence of chronic diseases and the emphasis on prompt medical intervention further propel the demand for efficient healthcare transportation services.

Healthcare Transportation Services Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 99.43 Billion |

| Market Size in 2024 | USD 106.02 Billion |

| Market Size by 2033 | USD 188.94 Billion |

| Market Growth Rate | CAGR of 6.63% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Key drivers shaping the healthcare transportation services market include technological advancements such as GPS tracking systems and telemedicine integration, which enhance service efficiency and patient outcomes. Additionally, government initiatives promoting universal healthcare coverage and regulations mandating safety standards for medical transport vehicles contribute to market expansion. The rise of specialized medical tourism and the need for disaster response logistics further bolster demand for reliable healthcare transportation solutions globally.

Opportunities

Opportunities in the healthcare transportation services market abound, driven by the increasing adoption of personalized healthcare services and the integration of artificial intelligence (AI) in logistics planning. The expansion of telehealth services and remote patient monitoring presents avenues for innovative transportation solutions catering to home healthcare needs. Furthermore, collaborations between healthcare providers and transportation service providers offer opportunities to streamline operations, reduce costs, and enhance service quality, especially in rural and underserved areas.

Challenges

Despite growth prospects, the healthcare transportation services market faces challenges such as stringent regulatory compliance requirements, particularly concerning patient safety and data protection. Economic pressures, including reimbursement constraints and fluctuating fuel costs, pose financial challenges for service providers. Moreover, addressing the diverse needs of patients with varying medical conditions and mobility restrictions necessitates customized transport solutions, adding complexity to service delivery. Additionally, competition among service providers intensifies as they strive to differentiate through service quality and operational efficiency.

Region Insights

The market for healthcare transportation services exhibits regional variations influenced by healthcare infrastructure development, regulatory frameworks, and demographic trends. Developed regions like North America and Europe boast well-established healthcare systems and stringent regulations, fostering a robust market for both emergency and non-emergency medical transportation. In contrast, emerging economies in Asia-Pacific and Latin America are witnessing rapid growth due to increasing healthcare investments, improving healthcare access, and rising disposable incomes.

Read Also: https://www.businesswebwire.com/mrna-vaccines-and-therapeutics-market/

Healthcare Transportation Services Market Companies

- Centene Corporation

- MedSpeed

- Force EMS

- DHL International GmBH,

- Watts Healthcare

- Crothall Healthcare

- Patriot Medical Transport

- WellMed Medical Management, Inc.

- FirstGroup Plc

- GoodFaith Medical Transportation

- Acadian Ambulance

- Aramark

- Piedmont Healthcare

- MTM

- OnTime Medical Transportation

- Hope Medical Transportation

- ProHealth Care

- Dash Xpress Medical Transport

- MTI America

- SCR Medical Transportation

- Molina Healthcare

- LogistiCare

Recent Developments

- On January 15, 2024, it was estimated that Government of India is revolutionizing healthcare in India with the help of Ministry of Electronic and IT, non-profit Organization, by providing digital innovations in India’s healthcare sector. The Digital India initiative has significantly transformed India’s health care system. E-Sanjeevani, CoWIN App, E-Hospital, Ayushman Bharat Digital Mission, Aarogya Setu and other initiatives have made health care services and facilities available throughout India. Through digital highways, these projects overcome the current distance between various healthcare ecosystem stakeholders.

- On March 27, 2024, according to the data published by the Medical Council of Canada, the government of Canada signed two mutual agreements with Quebec, located in central Canada to support initiatives to improve health care facilities in Canada. The signing of two bilateral agreements to provide more than US$3.7 billion in federal financing to enhance healthcare in Quebec was announced by Canada’s Health Minister. Under the government’s pledge to invest US$6.7 billion in Quebec over a ten-year period, these agreements signify the initial funding. The 2024–2027 strategic plan of Quebec’s Department of Health and Social Services will be initially supported by the Government of Canada with an allocation of US$2.5 billion.

Segments Covered in the Report

By Type

- Medical Transportation

- Pharmaceuticals

- Over the Counter Products

- Cosmetics

- Patient Transport

- Emergency

- Non-emergency

- Mental Health Transport

- Intensive Care Patient Transport

- Incubator Transport

- Mobile Treatment Facilities

- Non-medical Transport

- Mailroom Services

- Event Covers

- Medical Repatriation Services

- Courier Services

By End-Use

- Hospitals

- Medical Centers

- Private Paying Customers

- Nursing Care Facilities

- Airport Shuttle

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/