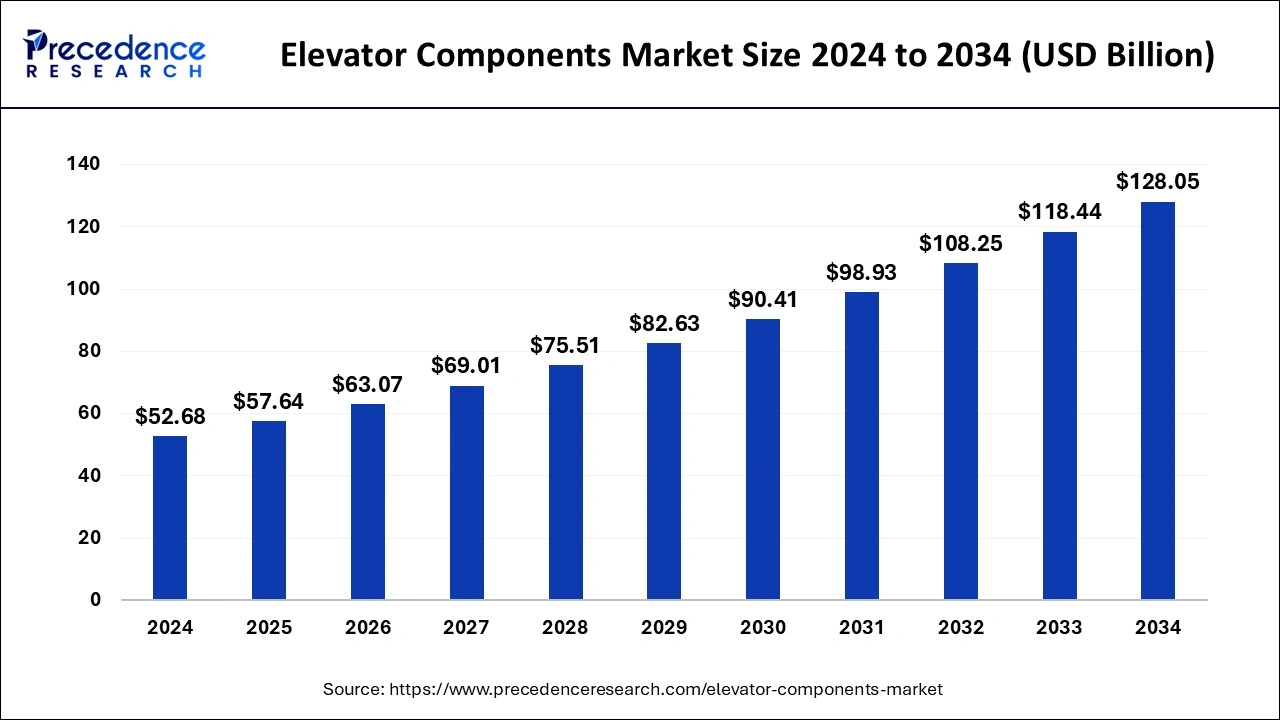

The global elevator components market size was evaluated at USD 48.14 billion by 2023 and is projected to gain around USD 118.44 billion by 2033 with a CAGR of 9.42 % between 2024 and 2033.

Key Points

- Asia Pacific dominated the market with the largest revenue share of 58% in 2023.

- North America is expected to witness significant growth in the market in the foreseeable period.

- By component, the motors segment has contributed more than 35% of revenue shares in 2023.

- By elevator technology, in 2023, the machine room-less elevator segment held a significant share of the market.

- By load capacity, the 650kg to 1000kg segment will witness a notable growth in the global market.

- By speed, the 4 to 6 m/s segment led the market in 2023.

- By end-use application, elevators for passenger segment has held a major revenue share of 82% in 2023.

Market Overview

The Elevator Components Market encompasses a wide array of parts essential for the operation and maintenance of elevators, including motors, control systems, cables, rails, doors, and safety devices. This market is driven by the increasing demand for vertical transportation solutions in residential, commercial, and industrial buildings. Technological advancements in smart elevators and the growing focus on energy efficiency and safety standards further propel the market forward. The market is characterized by intense competition among key players, continuous innovation, and strategic collaborations to meet diverse customer needs and regulatory requirements.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4472

Growth Factors

Several factors contribute to the growth of the Elevator Components Market. Urbanization and the expansion of high-rise buildings in metropolitan areas significantly drive the demand for elevators and their components. Additionally, the modernization of existing elevator systems to improve efficiency, safety, and performance plays a crucial role. The rise in disposable incomes and the increase in the construction of smart buildings equipped with advanced elevator systems also support market growth. Furthermore, government regulations mandating the incorporation of safety features in elevators boost the demand for high-quality components.

Elevator Components Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 118.44 Billion |

| Market Size in 2023 | USD 48.14 Billion |

| Market Size in 2024 | USD 52.68 Billion |

| Market Growth Rate | CAGR of 9.42% from 2024 to 2033 |

| Largest Market | Asia- Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Component, Load Capacity, Speed, End-use Applications, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Key drivers of the Elevator Components Market include the rapid pace of urbanization and the need for efficient vertical transportation in increasingly congested cities. The growing construction industry, particularly in developing economies, fuels the demand for elevators and their components. Technological advancements, such as the integration of Internet of Things (IoT) and artificial intelligence (AI) in elevator systems, enhance performance and user experience, driving market adoption. Additionally, the push for energy-efficient and eco-friendly solutions aligns with global sustainability goals, further driving market expansion.

Opportunities

The Elevator Components Market presents numerous opportunities for growth and innovation. The trend towards smart cities and buildings opens avenues for the development of advanced, intelligent elevator systems equipped with features like predictive maintenance, touchless operation, and enhanced security. Emerging markets, particularly in Asia-Pacific and Africa, offer significant growth potential due to increasing urbanization and infrastructure development. Collaborations between component manufacturers and construction firms to provide integrated solutions can also create new business opportunities. Furthermore, retrofitting and upgrading older elevator systems to meet modern standards provide a steady demand for components.

Challenges

Despite its growth prospects, the Elevator Components Market faces several challenges. The high cost of advanced components and systems can be a barrier to adoption, particularly in cost-sensitive markets. The complexity of integrating new technologies into existing infrastructure poses technical challenges. Additionally, stringent regulatory requirements and standards necessitate continuous compliance efforts, which can be resource-intensive. The market is also highly competitive, with numerous players vying for market share, leading to pricing pressures. Moreover, the need for skilled labor to install and maintain advanced elevator systems is a critical challenge in some regions.

Region Insights

Regionally, the Elevator Components Market exhibits varying trends and growth patterns. In North America and Europe, mature markets with a focus on modernization and energy efficiency drive demand for advanced components. These regions also emphasize stringent safety standards and regulations, contributing to market growth. In contrast, the Asia-Pacific region is experiencing rapid urbanization and industrialization, leading to a burgeoning construction sector and a high demand for new elevators and components. Countries like China and India are significant contributors to market growth in this region. The Middle East and Africa, with ongoing infrastructure development projects, also present growth opportunities. Latin America, though growing at a slower pace, is gradually adopting advanced elevator technologies, driven by urban development and modernization efforts.

Read Also: https://www.businesswebwire.com/north-america-liquid-packaging-market/

Elevator Components Market Companies

- Adams Elevator Equipment Company

- Avire Ltd

- DMG

- Bohnke and partner GmbH

- Elevator equipment corporation

- Elevator products corporation

- EMI/porta Inc.,

- Fermator group

- GAL Manufacturing Corp.

- Hans and Jos. Kronenberg

- Hissmekano AB

- Hydroware

- Kinds Teknik AB

- Nidec Kinetek elevator technology

- Wittur Group

Recent Development

In July 2022, Wittur launched a revamped model named semantic-C mode doors, including high technical functionalities that improve the overall performance of the motors of the elevators, which in turn helps to consume less electricity and improve cost-effectiveness.

Segments Covered in the Report

By Component

- Elevator Car and Shaft

- Landing Door

- Motor

- Machine Drive

- Tension Pulley

- Controller

- Counterweight Frame

- Guide Rails

- Car guide Rail

- Speed Governor

- Car Buffer

- Others

By Elevator Technology

- Hydraulic Elevators

- Traction Elevators

- Machine-room-less Elevators

- Pneumatic Elevators

By Load Capacity

- Below 650 kg

- 650-1000 kg

- 1000-1600 kg

- 2500-5000 kg

- Above 5000 kg

By Speed

- Less than 1m/s

- 1 to 3m/s

- 4 to 6 m/s

- 7 to 10m/s

- Above 10m/s

By End-use Applications

- Elevators for Passenger

- Elevator for Freight/load

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/