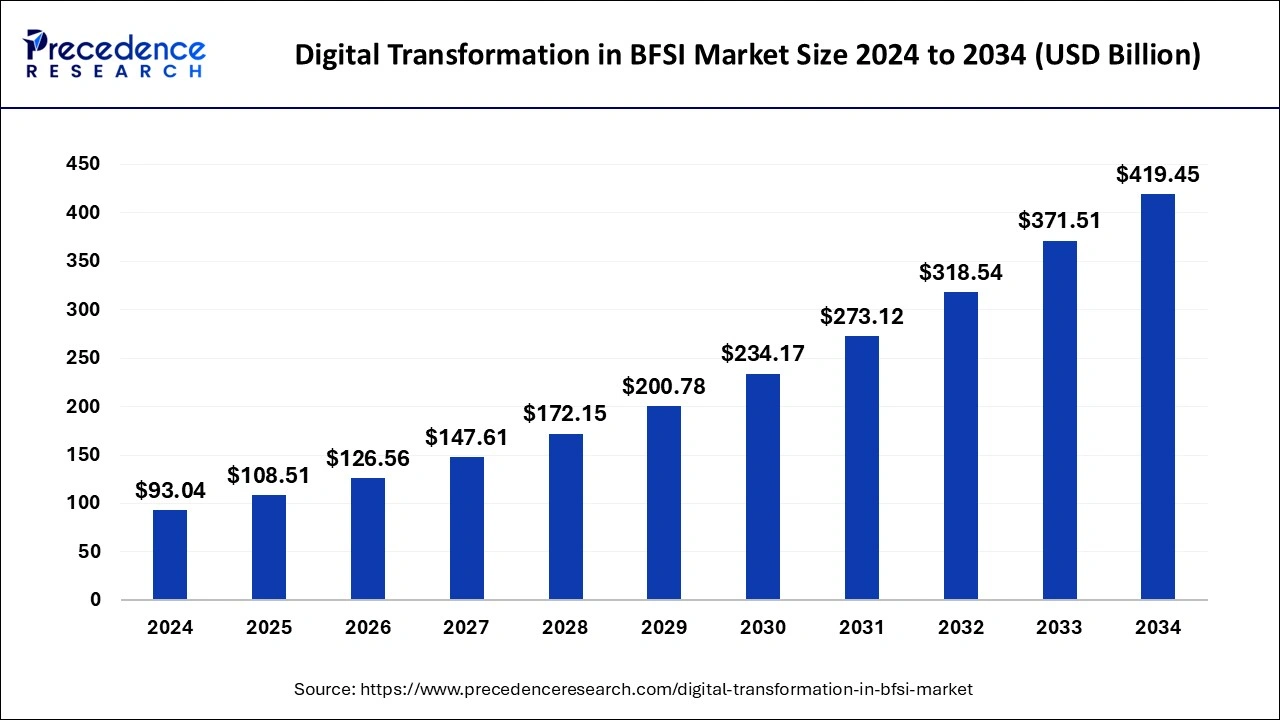

The global digital transformation in BFSI market size was evaluated at USD 79.77 billion by 2023 and is projected to gain around USD 371.51 billion by 2033 with a CAGR of 16.63% between 2024 and 2033.

Key Points

- North America led the digital transformation in BFSI market with the largest market size in 2023.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By component, the solution segment dominated the market with the highest growth in 2023.

- By deployment, the on-premise segment projected the highest growth in 2023.

- By deployment, the cloud segment is estimated to grow at the fastest rate during the forecast period.

- By enterprise, large enterprise segment dominated the market with the largest market share in 2023.

- By technology, the artificial intelligence segment dominated the market with the largest revenue in 2023.

- By end-user, the banks segment dominated the digital transformation in BFSI market in 2023.

Market Overview

The Digital Transformation in the BFSI (Banking, Financial Services, and Insurance) market involves the integration of digital technologies into all aspects of banking, financial services, and insurance operations. This transformation includes adopting technologies like AI, blockchain, cloud computing, big data analytics, and IoT to improve efficiency, enhance customer experiences, and drive innovation. The goal is to create more agile, responsive, and customer-centric financial institutions capable of competing in a rapidly evolving digital landscape.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4466

Growth Factors

The growth of digital transformation in the BFSI market is driven by several key factors. Increasing customer demand for seamless, personalized digital banking experiences is a primary driver. Additionally, advancements in technology such as AI and machine learning enable financial institutions to analyze vast amounts of data for better decision-making and risk management. The growing need for operational efficiency and cost reduction also fuels the adoption of digital solutions. Regulatory requirements and the rise of fintech startups challenging traditional banking models further accelerate this transformation.

Digital Transformation in BFSI Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 79.77 Billion |

| Market Size in 2024 | USD 93.04 Billion |

| Market Size by 2033 | USD 371.51 Billion |

| Market Growth Rate | CAGR of 16.63% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Component, Deployment, Enterprise, Technology, End-User and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Several drivers are pushing the digital transformation forward in the BFSI sector. The widespread adoption of smartphones and the internet has led to a surge in digital banking and mobile payment solutions. Regulatory pressure to enhance security and transparency, along with the necessity to prevent fraud and cyber-attacks, is another significant driver. The competitive landscape, influenced by fintech innovations, forces traditional banks to modernize their services. Moreover, the COVID-19 pandemic has highlighted the importance of digital channels, accelerating the shift towards digital banking and remote financial services.

Opportunities

The digital transformation in the BFSI market presents numerous opportunities. Enhanced data analytics capabilities allow institutions to offer more personalized and targeted services to their customers. Blockchain technology provides opportunities for more secure and transparent transactions, potentially revolutionizing areas like cross-border payments and identity verification. The adoption of AI and machine learning can lead to more accurate risk assessment and fraud detection. Furthermore, there are significant opportunities in underserved markets where digital solutions can provide access to financial services for previously unbanked populations.

Challenges

Despite the promising outlook, the digital transformation of the BFSI sector faces several challenges. Legacy systems and infrastructure can be significant barriers, as they are often not compatible with new digital technologies. The high cost of implementing digital solutions and ensuring cybersecurity can be daunting for many institutions. Data privacy concerns and regulatory compliance add additional layers of complexity. Furthermore, the skills gap in the workforce, where employees may lack the necessary digital literacy and expertise, poses a significant challenge.

Region Insights

The adoption and impact of digital transformation in the BFSI market vary by region. North America leads in digital banking innovations, driven by a high level of technological adoption and investment in fintech. Europe follows closely, with strong regulatory support for digital finance and a mature banking sector. The Asia-Pacific region is experiencing rapid growth, particularly in countries like China and India, where mobile banking and digital payment solutions are widely popular. In contrast, regions like Latin America and Africa are at earlier stages of digital transformation but hold substantial potential due to the growing penetration of smartphones and internet access.

Read Also: https://www.businesswebwire.com/sheet-metal-market/

Digital Transformation in BFSI Market Companies

- Oracle

- Fujitsu

- Accenture

- HID Global Corporation.

- SAP SE

- Google LLC

- AlphaSense Inc.

- Cognizant

- Microsoft Corporation

- International Business Machines Corporation

Recent Development

- In May 2024, Infosys, Tata Consulting Services, Tech Mahindra, and Wipro, all the IT companies, are winning the digital transformation deals in banking, financial services, and Insurance) industry. The organizations see the potential opportunities in core banking, payment, and other applications.

- In June 2024, InfoAxon comes into a strategic collaboration with Liferay to help boost the digital transformation for Reliance Digital Insurance (RGI). The collaboration is set to enhance RGI’s digital landscape and deliver a revolutionary journey to the consumer and prospects.

- In May 2024, ModernFi, an API-driven and fully integrated deposit network, announced the partnership with the Q2’s Digital Banking Platform through the Q2 Partner Accelerator Program. The collaboration brings a reciprocal program into digital banking.

- In May 2024, Decentro, India’s leading Fintech infrastructure platform, launched the next-generation Payment Stack. The platform is designed to cater to businesses delivering high performance, expansive payment needs, compliance, and security.

Segments Covered in the Report

By Component

- Solution

- Service

By Deployment

- On-Premise

- Cloud

By Enterprise

- Large Enterprises

- Small and Medium-sized Enterprises

By Technology

- Artificial Intelligence

- Cloud Computing

- Blockchain

- Big Data and Business Analytics

- Cybersecurity

- Others

By End-User

- Banks

- Insurance Companies

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/