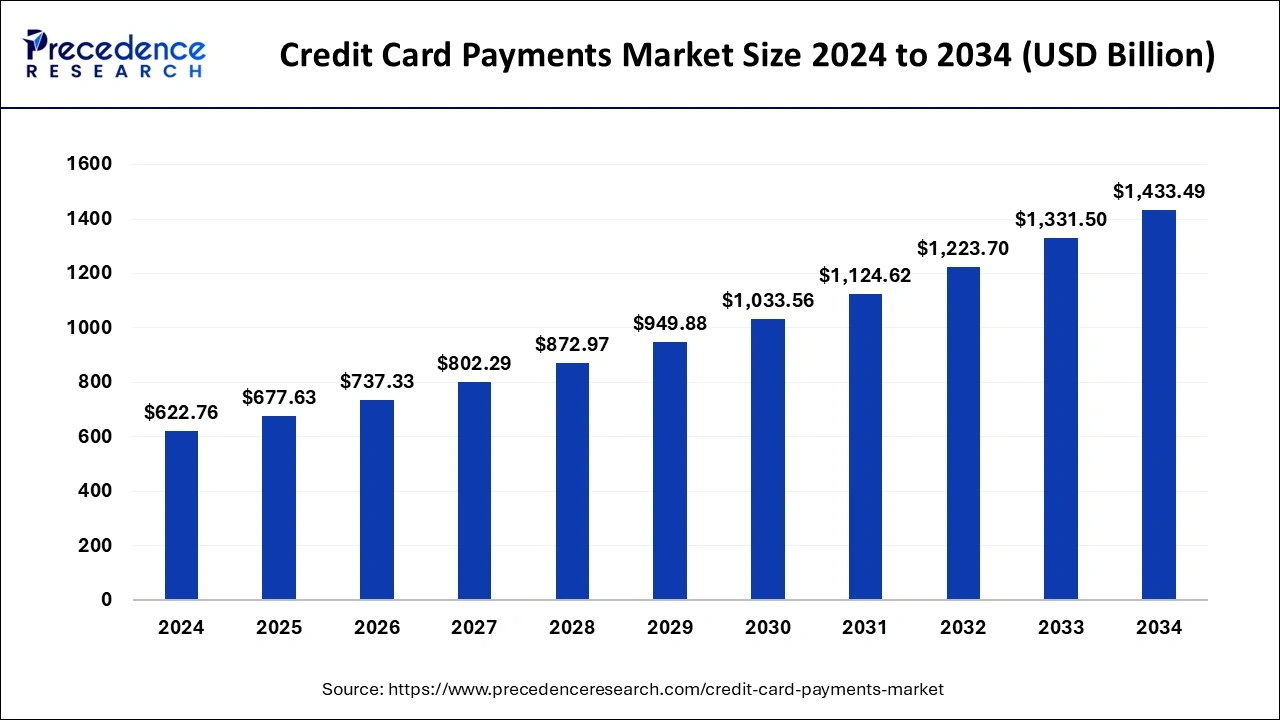

The global credit card payments market size was evaluated at USD 572.34 billion by 2023 and is projected to gain around USD 1,331.50 billion by 2033 with a CAGR of 8.81% between 2024 and 2033.

Key Takeaways

- The North America credit card payments market size reached USD 246.11 billion in 2023 and is expected to expand around USD 579.20 billion by 2033, at a CAGR of 8.93% from 2024 to 2033.

- North America held the dominant share of the credit card payments market in 2023.

- Europe is expected to expand at a rapid pace in the market during the forecast period.

- By card type, the general purpose credit cards segment accounted for the largest share of the market in 2023 and is projected to continue its dominance over the forecast period.

- By card type, the specialty & other credit cards segment is expected to witness considerable growth in the market over the forecast period.

- By application, the food & groceries segment held the largest share of the market in 2023.

- By application, the health & pharmacy segment is expected to grow significantly in the market during the forecast period.

- By provider, the Mastercard segment is estimated to hold the dominating share of the market during the forecast period.

- By provider, the Visa segment is expected to grow notably in the market over the studied period.

Market Overview

The credit card payments market has experienced significant growth over recent years, driven by the increasing adoption of digital payment methods and the proliferation of e-commerce. Credit cards remain a preferred payment method for consumers and businesses due to their convenience, security features, and the various rewards and benefits they offer. The market encompasses transactions made through physical credit cards, virtual cards, and mobile payment solutions that link to credit card accounts. The rise of contactless payments and advancements in financial technology (fintech) are further transforming the landscape, making credit card transactions faster and more secure.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4460

Growth Factors

Several factors contribute to the growth of the credit card payments market. The global shift towards a cashless economy has encouraged the adoption of credit cards. Moreover, the expanding e-commerce sector, which relies heavily on online payment methods, has boosted credit card usage. Innovations in fintech, such as mobile wallets and digital banking, are making it easier for consumers to access credit card services. Additionally, credit card companies continuously enhance their offerings with rewards programs, cashback, and travel benefits, which attract more users. The rise of contactless payment technologies, such as near-field communication (NFC), has also made credit card transactions more convenient and faster, further driving market growth.

Credit Card Payments Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 572.34 Billion |

| Market Size in 2024 | USD 622.76 Billion |

| Market Size by 2033 | USD 1,331.50 Billion |

| Market Growth Rate | CAGR of 8.81% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Card Type, Application, Provider, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Key drivers of the credit card payments market include technological advancements, increasing consumer preference for digital transactions, and the growth of the e-commerce industry. Technological innovations have improved the security and efficiency of credit card transactions, encouraging wider adoption. Consumers increasingly prefer the convenience and speed of credit card payments over traditional cash transactions. The booming e-commerce sector relies heavily on credit cards for online purchases, fueling market expansion. Additionally, partnerships between credit card companies and merchants, offering exclusive discounts and deals, drive consumer usage.

Opportunities

The credit card payments market presents numerous opportunities for growth. The expansion of digital payment infrastructure in emerging markets offers a significant opportunity for credit card companies to tap into new customer bases. The integration of artificial intelligence and machine learning in credit card services can enhance fraud detection and customer service, improving user experience. The growing trend of mobile payments and the development of super apps that integrate multiple financial services present opportunities for credit card companies to innovate and diversify their offerings. Additionally, the shift towards a cashless society in many regions creates a favorable environment for the growth of credit card usage.

Challenges

Despite the promising growth, the credit card payments market faces several challenges. Security concerns, particularly related to data breaches and fraud, remain a significant issue. Regulatory challenges also pose a threat, as governments around the world implement stringent regulations to protect consumers and maintain financial stability. High-interest rates and fees associated with credit card usage can deter potential users. Moreover, the increasing competition from alternative payment methods, such as digital wallets and cryptocurrencies, poses a challenge to the traditional credit card market. Economic downturns and fluctuations can also impact consumer spending behavior, affecting credit card transaction volumes.

Region Insights

Regionally, North America dominates the credit card payments market, driven by high consumer adoption rates and advanced digital infrastructure. The United States, in particular, is a significant contributor, with a well-established credit card ecosystem and a strong culture of credit card usage. Europe follows closely, with increasing adoption of contactless payments and robust regulatory frameworks that promote secure transactions. The Asia-Pacific region is witnessing rapid growth due to rising internet penetration, expanding e-commerce, and a growing middle-class population. Countries like China, India, and Japan are key markets in this region. In Latin America and the Middle East & Africa, the market is gradually expanding as digital payment infrastructure improves and financial inclusion initiatives gain traction.

Read Also: https://www.businesswebwire.com/blood-testing-market/

Credit Card Payments Market Companies

- American Express

- Bank of America

- Barclays

- Capital One

- Chase

- Citibank

- Discover

- HSBC

- ICICI Bank

- JPMorgan

- Mastercard

- MUFG

- Santander

- SBI Cards

- State Farm

- U.S. Bancorp

- Visa

- Wells Fargo

- Westpac

- Worldpay

Recent Developments

- In February 2024, American Express and Delta Air Lines unveiled upgraded Delta SkyMiles American Express Cards, intended to improve the travel experience and provide everyday value to consumers and business owners.

- In March 2024, SBI Card, in partnership with Titan Company Ltd, announced the launch of Titan SBI Card. Titan SBI Card offers features that include cashback, titan gift vouchers, and reward points. The cardholders can avail benefits worth over Rs. 2,00,000 per annum.

- In June 2024, Adani One and ICICI Bank announced the launch of India’s first co-branded credit cards with airport-linked benefits in collaboration with Visa. Available in two variants – Adani One ICICI Bank Signature Credit Card and Adani One ICICI Bank Platinum Credit Card – the cards offer a substantial reward program.Companies

Segments Covered in the Report

By Card Type

- General Purpose Credit Cards

- Specialty and Other Credit Cards

By Application

- Food and Groceries

- Health and Pharmacy

- Restaurants and Bars

- Consumer Electronics

- Media and Entertainment

- Travel and Tourism

- Other Applications

By Provider

- Visa

- Mastercard

- Other Providers

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/