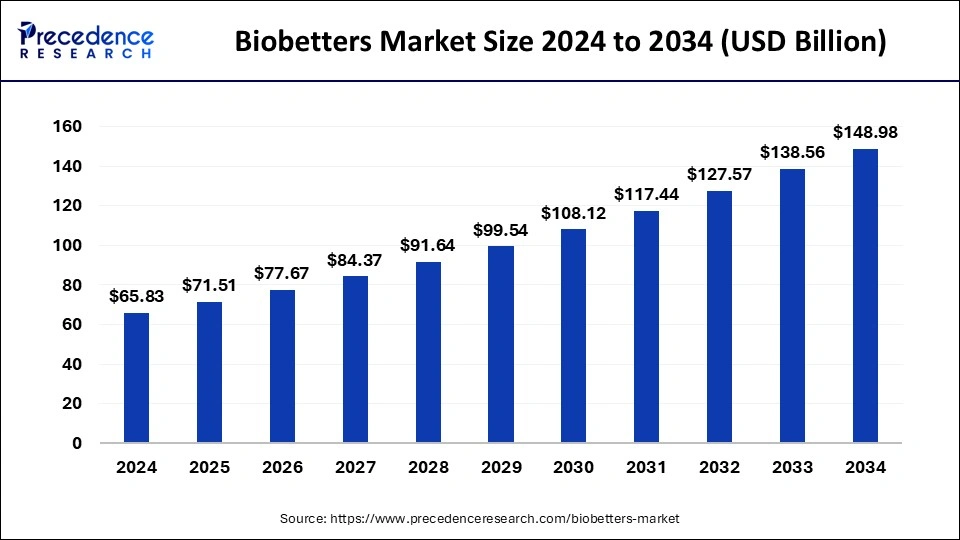

The global biobetters market size was evaluated at USD 60.61 billion by 2023 and is projected to gain around USD 138.56 billion by 2033 with a CAGR of 8.62% between 2024 and 2033.

Key Points

- North America dominated the biobetters market in 2023.

- Asia- Pacific shows a significant growth in the biobetters market during the forecast period.

- By molecule type, the monoclonal antibodies biobetters segment dominated the market in 2023.

- By molecule type, the insulin biobetters segment is observed to be the fastest growing in the biobetters market during the forecast period.

- By disease indication, the cancer segment dominated the market in 2023.

- By disease indication, the neurological disorders segment shows a significant growth in the biobetters market during the forecast period.

- By distribution channel, the hospital pharmacy segment dominated the market.

- By distribution channel, the online pharmacy segment shows a notable growth in the biobetters market during the forecast period.

Market Overview

The biobetters market refers to the sector of the biopharmaceutical industry that focuses on the development and commercialization of biobetters, which are improved versions of existing biologic drugs. These enhancements may include better efficacy, reduced side effects, improved delivery methods, or extended half-life. Biobetters are designed to offer significant advantages over their predecessor biologics, which can lead to enhanced patient outcomes and greater market competitiveness. The market for biobetters is expanding as pharmaceutical companies leverage advanced biotechnology to optimize existing treatments and meet the evolving needs of patients and healthcare systems.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4504

Growth Factors

The growth of the biobetters market is driven by several key factors. Advancements in biotechnology and genetic engineering have enabled the development of more sophisticated and effective biologic drugs. There is a growing demand for more efficient and safer therapeutic options among patients and healthcare providers. Additionally, regulatory agencies are increasingly recognizing the potential of biobetters, providing clearer pathways for their approval. Investments in research and development by major pharmaceutical companies are also boosting the market, as these firms seek to differentiate their product portfolios and address unmet medical needs.

Biobetters Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 138.56 Billion |

| Market Size in 2023 | USD 60.61 Billion |

| Market Size in 2024 | USD 65.83 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 8.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Molecule Type, Disease Indication, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Several drivers are propelling the biobetters market forward. The need for improved therapeutic outcomes and patient compliance is a significant motivator for the development of biobetters. These drugs often offer superior efficacy and reduced side effects compared to their original biologics. The patent expirations of many blockbuster biologics present an opportunity for companies to introduce biobetters as next-generation treatments. Additionally, advancements in drug delivery technologies and bioprocessing are enabling the creation of more effective and patient-friendly biobetters.

Opportunities

The biobetters market presents numerous opportunities for growth and innovation. One key opportunity lies in the development of biobetters for complex and chronic diseases, where existing biologics may have limitations. Emerging markets with growing healthcare infrastructures and increasing access to advanced therapies offer substantial growth potential. Strategic partnerships and collaborations between biotech firms and academic institutions can accelerate the development of innovative biobetters. Furthermore, the increasing adoption of personalized medicine approaches provides an avenue for creating biobetters tailored to specific patient populations.

Challenges

Despite the promising outlook, the biobetters market faces several challenges. The development and commercialization of biobetters require significant investment in research and development, which can be a barrier for smaller companies. Navigating the complex regulatory landscape for biobetters can also be challenging, as these products must demonstrate substantial improvements over existing biologics. Additionally, competition from biosimilars—generic versions of biologic drugs—poses a threat, as they are often cheaper and more readily accepted by healthcare systems. Ensuring consistent manufacturing quality and scalability remains a critical hurdle as well.

Region Insights

The biobetters market exhibits varied dynamics across different regions. North America, particularly the United States, holds a significant share of the market due to its advanced healthcare infrastructure, substantial R&D investments, and favorable regulatory environment. Europe follows closely, with countries like Germany and the UK being key players in biopharmaceutical innovation. The Asia-Pacific region is expected to witness rapid growth, driven by increasing healthcare expenditures, rising prevalence of chronic diseases, and expanding biopharma capabilities in countries like China and India. Latin America and the Middle East & Africa are emerging markets with potential for growth as healthcare access and infrastructure improve.

Read Also: https://businesswebwire.com/heavy-construction-equipment-market/

Biobetters Market Comppnies

- F. Hoffmann-La Roche AG

- Merck & Co. Inc.

- SERVIER

- Eli Lily and Company

- Biogen Inc.

- Teva Pharmaceutical Industries Ltd.

- Sanofi SA

- Porton Biopharma Limited

- Novo Nordisk A/S

- CSL Behring GmbH

Recent Developments

- In June 2024, As reported by Syngene International Ltd, a new platform for producing proteins has been launched. The platform combines Syngene’s clone selection and development procedures with in-licensed cell line and transposon-based technology from the Swiss biotech services company ExcellGene, which should result in a notable increase in accuracy and efficiency. By speeding up improved protein manufacturing, the new platform shortens the time to market by facilitating faster preclinical, clinical, and commercial launches.

- In November 2023, the most recent addition to 3M’s line of chromatographic clarifiers was revealed. Harvest RC Chromatographic Clarifier, model number BT500, is a 500 mL, single-use chromatographic clarifier for monoclonal antibodies, recombinant proteins, and biologics.

- In March 2022, ProteoGenix declared the XtenCHOTM Transient Expression System to be available. The novel patented mammalian cell-based expression host provides up to ten times greater yields with less hands-on time than previous options because of its improved metabolism and enhanced plasmid stability. The novel CHO host seeks to expedite early-phase drug screening and streamline the creation of recombinant proteins.

Segments Covered in the Report

By Molecule Type

- G-CSF Biobetters

- Insulin Biobetters

- Erythropoietin Biobetters

- Monoclonal Antibodies Biobetters

- Others

By Disease Indication

- Cancer

- Diabetes

- Genetic Disease

- Neurological Disorders

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/