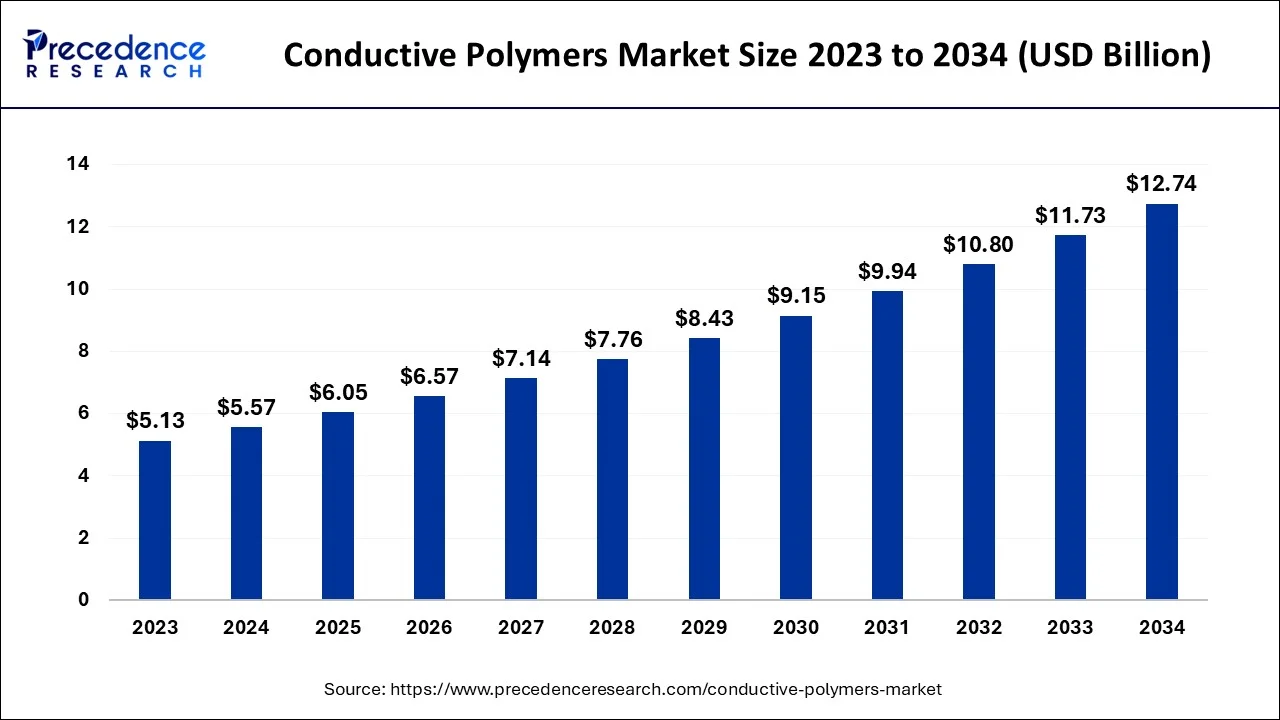

The global conductive polymers market size was evaluated at USD 5.57 billion by 2024 and is projected to gain around USD 12.74 billion by 2034 with a CAGR of 8.62% between 2024 and 2034.

Key Takeaways

- Asia Pacific dominated the conductive polymers market with the largest market share of 47% in 2023.

- North America held the second largest market share of 21% in 2023.

- By product, the polyacetylene (PA) segment held a significant market share in 2023

- By product, the Poly(Phenylenevinylene) (PPV) segment is expected to grow at a notable rate over the forecast period.

- By application, the actuators & sensors segment accounted for the dominating share of the market in 2023.

- By application, the solar energy segment will witness considerable growth in the market over the forecast period.

Get Sample Copy of This Report@ https://www.precedenceresearch.com/sample/5110

Conductive Polymers Market Overview

The Conductive Polymers Market involves the production and application of polymers that exhibit electrical conductivity. These polymers are a unique class of materials that combine the flexibility, lightweight, and processability of plastics with the electronic properties of metals. Common conductive polymers include polyaniline, polypyrrole, and polyacetylene. They are widely used in industries such as electronics, energy, healthcare, and automotive, where their ability to conduct electricity can enhance product functionality, such as in the creation of flexible circuits, capacitors, sensors, and electrochemical devices.

As industries increasingly shift towards lightweight, flexible, and sustainable materials, conductive polymers are becoming essential components in modern applications, driving substantial market growth.

Growth Factors

Several factors are propelling the growth of the conductive polymers market. The rise in demand for flexible and wearable electronics, such as smartwatches, fitness trackers, and other health monitoring devices, is one of the primary growth drivers. These applications require materials that are both flexible and capable of conducting electricity, making conductive polymers an ideal solution.

Furthermore, the increasing focus on lightweight materials in the automotive and aerospace industries to enhance fuel efficiency and reduce emissions is boosting demand for conductive polymers. The rise of renewable energy technologies, particularly in solar cells and energy storage devices, also contributes to market expansion, as conductive polymers play a key role in enhancing the efficiency of these systems.

Conductive Polymers Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.74 Billion |

| Market Size in 2024 | USD 5.57 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.62% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Conductive Polymers Market Dynamics

Drivers

The key drivers of the conductive polymers market include advancements in the electronics industry, especially the miniaturization of electronic components and devices. These advancements require materials that are not only conductive but also lightweight and flexible. Additionally, the growing interest in sustainable materials is driving innovation in conductive polymers, which can be made more environmentally friendly than traditional metals. The rise of smart textiles, where conductive polymers are used in embedded sensors and electronic systems, further fuels market demand. Government initiatives to promote green energy solutions, particularly in the solar energy sector, where conductive polymers can be used in organic solar cells, are also boosting market growth.

Opportunities

Opportunities in the conductive polymers market are vast, particularly with the increasing integration of Internet of Things (IoT) technologies in various industries. IoT devices, which often require flexible, lightweight, and low-cost conductive materials, present a significant market for conductive polymers. Furthermore, the healthcare industry offers growing opportunities, as conductive polymers are used in bioelectronics, medical sensors, and drug delivery systems.

The expansion of 3D printing technology also opens new avenues for conductive polymers, allowing for the production of customized electronic components with ease. There is also significant potential in energy storage technologies, particularly in supercapacitors and flexible batteries, where conductive polymers can improve performance and efficiency.

Challenges

Despite its growth potential, the conductive polymers market faces several challenges. One major issue is the relatively high cost of some conductive polymers compared to traditional materials, which can limit their adoption, particularly in cost-sensitive industries. Additionally, while conductive polymers offer many benefits, their conductivity levels often do not match those of metals, which can be a limiting factor in certain high-performance applications. Furthermore, the production processes for some conductive polymers can be complex, requiring advanced manufacturing techniques that may not be readily available in all regions. The lack of standardization in performance metrics and testing methods for conductive polymers also poses a challenge to widespread adoption.

Region Insights

Regionally, the Asia-Pacific region dominates the conductive polymers market due to its large electronics manufacturing base, particularly in countries like China, Japan, and South Korea. The region’s growing automotive industry and increasing investments in renewable energy are also contributing to market expansion. North America is another significant market, driven by technological advancements, particularly in healthcare, aerospace, and defense sectors.

The United States is a key player in this region, with substantial investments in research and development for advanced materials. Europe is experiencing steady growth, particularly in the automotive and renewable energy sectors, where there is a strong focus on reducing emissions and improving energy efficiency. Latin America and the Middle East & Africa are emerging markets, with growing opportunities in electronics and renewable energy sectors. However, these regions face challenges related to limited infrastructure and technical expertise in conductive polymer production and application.

Read Also: Neurological Biomarkers Market Size to Gain Around USD 30.77 Billion by 2034

Recent Developments

- In October 2022, NICHICON CORPORATION developed the PCA Series of chip-type conductive polymer aluminum solid electrolytic capacitors for use in automotive and industrial equipment environments requiring high reliability. The PCA Series has the same ESR and other characteristics as the current PCR Series at 125°C and has improved the ripple current, achieving industry-leading ripple current capability at 125°C.

- In April 2021, new conductive polymer ink will be used for next-generation printed electronics. Researchers at Linköping University, Sweden, have developed a stable, high-conductivity polymer ink. The advance paves the way for innovative printed electronics with high energy efficiency.

- In February 2022, PolyJoule, Inc., a developer of Ultra-Safe, non-metallic energy storage, announced manufacturing validation of its conductive polymer battery technology after a 10,000+ cell manufacturing run. The new batteries are based on PolyJoule’s proprietary conductive polymers and other organic, non-metallic materials and are designed to suit the needs of stationary power applications where safety, lifetime, levelized costs, and environmental footprints are key decision drivers.

Conductive Polymers Market Companies

- 3M Company

- Agfa-Gevaert Group

- Celanese Corporation

- Heraeus Holding

- Hyperion Catalysis International

- Lehmann&Voss&Co.

- Parker Hannifin Corp.

- PolyOne Corporation

- Premix Group

- RTP Company

- The Lubrizol Corporation

- Kemet Corporation

- Heraeus Holding GmbH

- American Dyes Inc.

- Rieke Metals

- SABIC

- Solvay SA

- ABTECH Scientific

Segments Covered in the Report

By Product

- Polyacetylene (PA)

- Polyaniline (PANI)

- Polypyrrole (PPy)

- Polythiophene (PTH)

- Poly(Para-Phenylene) (PPP)

- Poly(Phenylenevinylene) (PPV)

- Polyfuran (PF)

- Others

By Application

- Batteries

- Polymer capacitor

- Actuators and sensors

- Anti-static packaging &coatings

- Photographic film

- Solar energy

- Display screen

- Led lights

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/5110

Contact Us:

Mr. Alex

Sales Manager

Call: + 1 804 441 9344

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.reportsgazette.com/