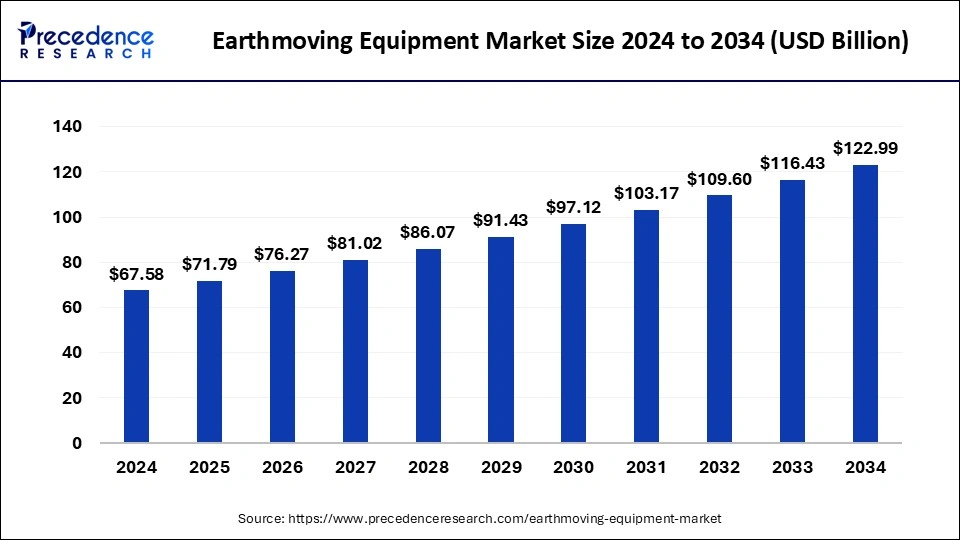

The global earthmoving equipment market size was evaluated at USD 63.62 billion by 2023 and is projected to gain around USD 116.43 billion by 2033 with a CAGR of 6.23% between 2024 and 2033.

Key Points

- Asia Pacific led the earthmoving equipment market with the largest market share in 2023.

- North America is expected to witness the fastest growth in the market during the forecast period.

- By product, the excavators segment dominated the market with the largest market share in 2023.

- By application, the construction segment projected the largest revenue in the market in 2023.

Market Overview

The earthmoving equipment market encompasses a wide range of machinery designed for construction, mining, and other heavy-duty applications. This category includes excavators, loaders, bulldozers, and other machinery that can move large quantities of earth and materials. These machines are essential for infrastructure development, road construction, mining operations, and residential projects. The market is characterized by continuous technological advancements aimed at improving efficiency, safety, and environmental compliance.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4508

Growth Factors

Several factors contribute to the growth of the earthmoving equipment market. Rapid urbanization and industrialization in emerging economies drive the demand for infrastructure development. Government investments in public infrastructure projects, such as highways, railways, and airports, further bolster market growth. Additionally, the rise in construction activities due to an increase in housing and commercial real estate projects is a significant growth driver. The ongoing trend towards automation and the integration of advanced technologies like IoT and AI in equipment also enhance operational efficiency, propelling market expansion.

Earthmoving Equipment Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 116.43 Billion |

| Market Size in 2023 | USD 63.62 Billion |

| Market Size in 2024 | USD 67.58 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 6.23% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

Drivers

Key drivers of the earthmoving equipment market include the robust growth in the construction sector and the escalating need for infrastructure development. The mining industry’s expansion, driven by the increasing demand for minerals and resources, also fuels the market. Technological advancements leading to the development of more efficient and environmentally friendly equipment attract end-users, contributing to market growth. Moreover, government regulations promoting the use of eco-friendly machinery and equipment with lower emissions are compelling manufacturers to innovate and expand their product offerings.

Opportunities

The earthmoving equipment market presents numerous opportunities, particularly in the areas of technological innovation and geographical expansion. The integration of smart technologies, such as GPS and telematics, offers significant opportunities for improving machine performance and operational efficiency. Emerging markets, particularly in Asia-Pacific and Latin America, provide substantial growth prospects due to their rapid industrialization and urbanization. Additionally, the trend towards renting rather than purchasing equipment offers growth potential for rental services and leasing companies within the market.

Challenges

Despite the positive outlook, the earthmoving equipment market faces several challenges. High initial investment costs and maintenance expenses can deter smaller companies from adopting advanced equipment. Economic fluctuations and uncertainties in the construction sector can impact market stability. Additionally, stringent environmental regulations and emission standards pose challenges for manufacturers to comply without escalating production costs. The market is also highly competitive, with major players continuously innovating to gain a competitive edge, making it difficult for new entrants.

Region Insights

Regionally, the earthmoving equipment market exhibits varied growth patterns. Asia-Pacific is the largest and fastest-growing market, driven by substantial infrastructure development and construction activities in countries like China, India, and Japan. North America and Europe also represent significant markets due to their well-established construction industries and ongoing infrastructure projects. In North America, the demand is further fueled by the replacement of aging infrastructure. In Europe, strict environmental regulations drive the adoption of advanced, eco-friendly equipment. Latin America and the Middle East & Africa are emerging markets with growing construction and mining activities, offering promising growth opportunities.

Read Also: https://www.businesswebwire.com/anti-inflammatory-biologics-market/

Earthmoving Equipment Market Companies

- AB Volvo

- BEML LIMITED.

- Bobcat Company

- Caterpillar

- CNH Industrial N.V.

- Deere & Company

- Doosan Corporation

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- J C Bamford Excavators Ltd.

- Kobelco Construction Machinery Co. Ltd

- Komatsu Ltd.

- LIEBHERR

- SANY Group

- Sumitomo Heavy Industries, Ltd.

- Terex Corporation

- XCMG Group

- Zoomlion Heavy Industry Science&Technology Co., Ltd.

Recent Developments

- In June 2024, Volvo CE launched L120 Electric heavy-duty electric earthmoving machines with the lifting capacity of 6 tonnes. With featuring mobile charging units that used to charge the equipments in the construction site with insufficient power grid connection.

- In May 2024, FuelPro Trailers, a leading player of diesel fuel, and service trailers added the new member in its fuel trailers portfolio like the economical 500-gallon FuelPro 500. These fuel trailers allow farmers, contractors, and farmers to refuel equipments on site effectively.

- In May 2024, Volvo CE launched the range of new excavators EC210, EC230, EC370, EC400 and EC500, and ECR145 short swing crawler excavators with enhanced performance, safety, and operator features.

Segment Covered in the Report

By Product

- Excavators

- Loaders

- Backhoes

- Compaction Equipment

- Others

By Application

- Construction

- Underground Mining

- Surface Mining

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/