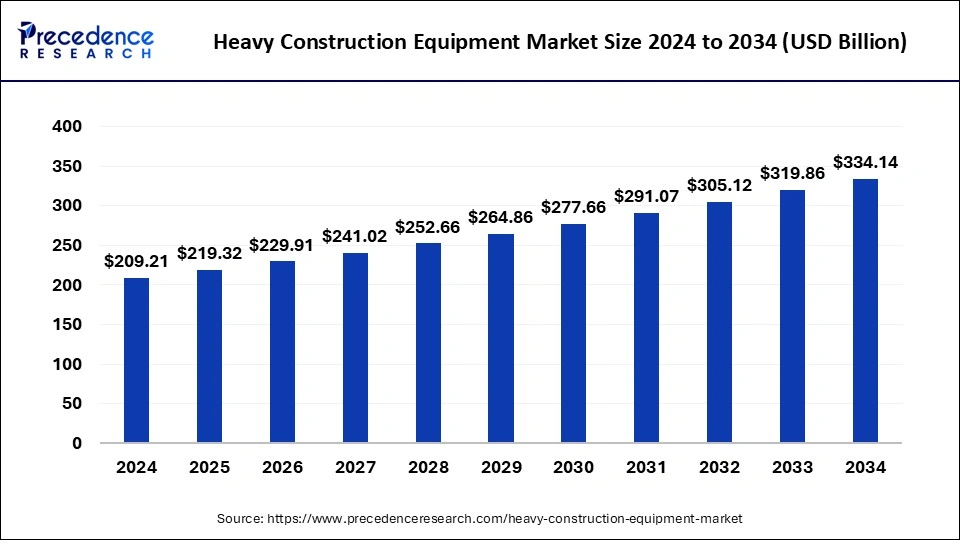

The global heavy construction equipment market size was evaluated at USD 199.58 billion by 2023 and is projected to gain around USD 319.86 billion by 2033 with a CAGR of 4.83% between 2024 and 2033.

Key Points

- Asia Pacific led the market with the largest revenue share of 38% in 2023.

- North America is expected to witness the fastest rate of growth in the market during the forecast period.

- By product, the earthmoving machineries segment held the largest share of the market in 2023.

- By application, the infrastructure segment dominated the market with the largest share in 2023.

Market Overview

The Heavy Construction Equipment Market encompasses a wide array of machinery used for various construction activities, including earthmoving, lifting, material handling, and other critical construction operations. Key equipment in this market includes excavators, loaders, bulldozers, cranes, and forklifts. The market is driven by increasing investments in infrastructure development, urbanization, and the growing demand for advanced machinery that offers higher efficiency and productivity. The market is also characterized by continuous technological advancements, such as the integration of IoT and telematics, which enhance the operational efficiency and safety of the equipment.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4503

Growth Factors

The primary growth factors for the Heavy Construction Equipment Market include the rapid pace of urbanization and industrialization, particularly in emerging economies. This urban expansion necessitates significant infrastructure development, including roads, bridges, and buildings, driving the demand for construction machinery. Additionally, government initiatives and investments in infrastructure projects, such as smart cities and transportation networks, further propel market growth. Technological advancements that improve the efficiency, safety, and environmental impact of heavy construction equipment also contribute to market expansion.

Heavy Construction Equipment Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 319.86 Billion |

| Market Size in 2023 | USD 199.58 Billion |

| Market Size in 2024 | USD 209.21 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 4.83% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Several key drivers are fueling the growth of the Heavy Construction Equipment Market. The ongoing trend of urbanization and the need for robust infrastructure in both developed and developing regions is a significant driver. Furthermore, the construction industry’s move towards automation and the adoption of advanced technologies such as artificial intelligence, machine learning, and IoT in machinery are boosting productivity and operational efficiency. The increasing focus on sustainable and eco-friendly construction practices also drives the demand for advanced equipment that meets stringent environmental regulations.

Opportunities

The Heavy Construction Equipment Market presents numerous opportunities for growth and innovation. The increasing adoption of electric and hybrid construction equipment offers a significant opportunity, driven by the global push towards reducing carbon emissions and enhancing sustainability. Additionally, the rise of smart construction and the integration of digital technologies, such as Building Information Modeling (BIM) and augmented reality (AR), present opportunities for enhancing the efficiency and accuracy of construction projects. Emerging markets, particularly in Asia-Pacific and Africa, offer substantial growth opportunities due to their rapid urbanization and infrastructure development needs.

Challenges

Despite its growth prospects, the Heavy Construction Equipment Market faces several challenges. The high initial costs associated with purchasing advanced construction machinery can be a barrier for smaller construction companies. Additionally, the market is highly competitive, with major players constantly innovating to maintain their market position, which can pose a challenge for new entrants. Fluctuations in raw material prices, such as steel and iron, also impact the cost of equipment manufacturing, affecting market dynamics. Moreover, stringent environmental regulations and the need for continuous compliance can be challenging for manufacturers and users alike.

Region Insights

Regionally, the Asia-Pacific region dominates the Heavy Construction Equipment Market, driven by rapid urbanization, industrialization, and significant infrastructure investments in countries like China and India. North America and Europe also hold substantial market shares, supported by ongoing infrastructure renewal projects and the adoption of advanced construction technologies. In contrast, the Middle East and Africa are emerging markets with growing potential due to increasing government investments in large-scale infrastructure projects. Latin America, while smaller in comparison, is witnessing steady growth driven by urban development and infrastructure modernization efforts.

Read Also: https://www.businesswebwire.com/artificial-intelligence-in-logistics-market/

Heavy Construction Equipment Market Companies

- Hitachi Construction Machinery Co. Ltd.

- Liebherr

- Deere & Company

- Doosan Bobcat

- XCMG Group

- SANY Group

- Zoomlion Heavy Industry Science & Technology Co. Ltd.

Recent Development

- In May 2024, Range Energy (Range) the organization empowering the powered trailers to the commercial trucking market announced the strategic collaboration with Dot Transportation Inc., which is the affiliate transportation of Dot Foods the largest redistributor of food industry in North America for introducing and installing the refrigerated version Range’s electric-powered trailer.

- In May 2024, Telestack, a leading company in material handling solutions is launching its revolutionary product, TSR40 radial telescopic conveyor in the Hillhead 2024, a premium exhibition for showcasing construction, quarrying, and recycling industries.

- In June 2024, Roads and Transport Authority (RTA) launched the latest Dubai commercial and Logistics Land Transport Strategy 2030 with the vision of doubling the direct contribution for the logistics and land transport sector to the Emirate’s economy AED 16.8 billion ($4.5 billion).

- In June 2024, Volvo CE, a leading heavy-duty vehicle company is launched the electric solutions like corded EW240 Electric MH, and the 23-tonne EC230 Electric excavator, the company introduces the range of new battery electric machines in Eskilstuna, Sweden. Volvo also launched its first electric wheeled excavator, the EWR150 Electric, and L90 Electric and L120 Electric wheel loaders, which will available in the limited quantity in the selected markets from 2025. The company further introducing PU40 mobile energy storage system for small equipment for the charging of construction equipments in the remote locations without power grid.

Segments Covered in the Report

By Product

- Earth Moving Machinery

- Material Handling Machinery

- Concrete & Road Machinery

- Others

By Application

- Infrastructure

- Real Estate

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/