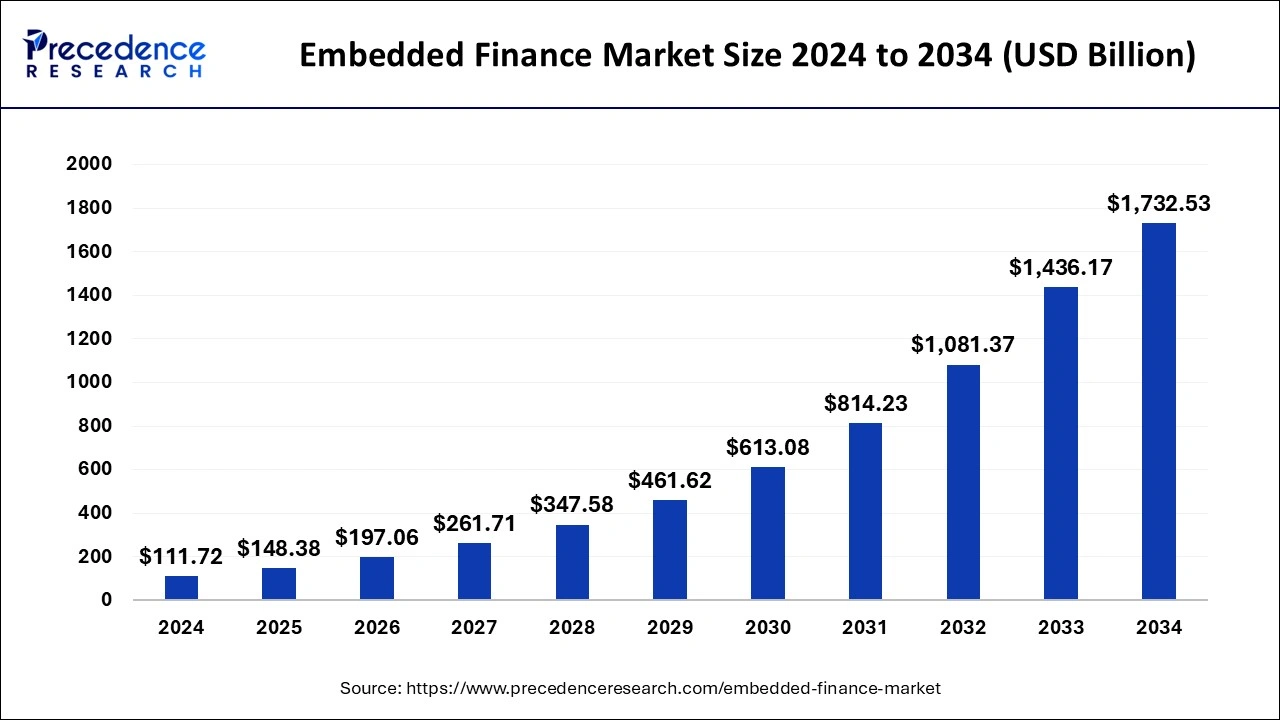

The global embedded finance market size was evaluated at USD 84.12 billion by 2023 and is projected to gain around USD 1,436.17 billion by 2033 with a CAGR of 32.81% between 2024 and 2033.

Key Points

- The North America embedded finance market size is exhibited at USD 27.76 billion in 2023 and is expected to attain around USD 481.12 billion by 2033, poised to grow at a CAGR of 33% between 2024 and 2033.

- North America has contributed more than 33% of revenue share in 2023.

- Asia- Pacific is the fastest growing in the embedded finance market during the forecast period.

- By type, the embedded payment segment has held a largest revenue share of 39% in 2023.

- By type, the embedded lending segment shows significant growth in the embedded finance market during the forecast period.

- By business model, the B2B segment dominated the market in 2023.

- By business model, the B2C segment shows a significant growth in the embedded finance market during the forecast period.

- By end-use, the retail segment dominated the embedded finance market.

- By end-use, the travel & entertainment segment is the fastest growing in the embedded finance market during the forecast period.

Market Overview

The Embedded Finance Market is a rapidly evolving sector that integrates financial services directly into non-financial platforms, products, or services. This market includes services such as payments, lending, insurance, and investment, embedded within various industries including e-commerce, healthcare, and transportation. By enabling seamless financial transactions within these platforms, embedded finance enhances user experience and opens new revenue streams for businesses. This convergence of technology and finance is reshaping traditional financial services, making them more accessible and efficient for consumers and businesses alike.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4480

Growth Factors

The growth of the Embedded Finance Market is driven by several key factors. The increasing digitalization across industries is a major catalyst, as businesses seek to offer more integrated and convenient services to their customers. The proliferation of APIs (Application Programming Interfaces) has facilitated easier integration of financial services into various platforms. Additionally, consumer demand for seamless and instant financial transactions is pushing businesses to adopt embedded finance solutions. The rise of fintech companies and technological advancements in AI and blockchain are also contributing significantly to the market’s expansion.

Embedded Finance Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 1,436.17 Billion |

| Market Size in 2023 | USD 84.12 Billion |

| Market Size in 2024 | USD 111.72 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 32.81% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Business Model, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Several drivers are propelling the Embedded Finance Market forward. The demand for improved customer experience and personalized services is a primary driver, as embedded finance allows companies to tailor financial services to individual needs. The competitive advantage that embedded finance provides businesses is another crucial driver, enabling companies to differentiate themselves in crowded markets. The increasing use of mobile devices and internet penetration is further accelerating the adoption of embedded financial services. Moreover, regulatory support and evolving financial regulations are making it easier for non-financial companies to offer financial services.

Opportunities

The Embedded Finance Market presents numerous opportunities for growth and innovation. Companies in various sectors can explore new business models and revenue streams by integrating financial services into their offerings. There is significant potential for partnerships between fintech firms and traditional businesses, enabling the latter to leverage advanced financial technologies. Emerging markets offer vast opportunities due to the relatively lower penetration of traditional banking services, allowing embedded finance to bridge the gap. Additionally, advancements in AI and machine learning can lead to more sophisticated and secure embedded financial solutions.

Challenges

Despite its promising growth, the Embedded Finance Market faces several challenges. Regulatory and compliance issues are a major hurdle, as the integration of financial services requires adherence to complex financial regulations. Data privacy and security concerns are also significant, given the sensitive nature of financial information. The need for robust technology infrastructure can be a barrier for smaller businesses or those in developing regions. Moreover, the market is highly competitive, with numerous players vying for market share, which can make it difficult for new entrants to establish themselves.

Region Insights

The Embedded Finance Market exhibits regional variations in its adoption and growth. North America, particularly the United States, is a leading region due to its advanced technology infrastructure and strong fintech ecosystem. Europe is also a significant market, driven by supportive regulatory frameworks and high digital adoption rates. In Asia-Pacific, countries like China and India are witnessing rapid growth, fueled by increasing internet penetration and a large base of tech-savvy consumers. Latin America and Africa, though still in the nascent stages, present considerable growth potential due to the increasing demand for accessible financial services and the rising adoption of digital technologies.

Read Also: https://www.businesswebwire.com/micropump-market/

Embedded Finance Market Companies

- Stripe, Inc.

- PAYRIX

- Cybrid Technology Inc.

- Walnut Insurance Inc.

- Lendflow

- Finastra

- Transcard Payments

- Fluenccy Pty Limited

- Zopa Bank Limited

- Fortis Payment Systems, LLC

Recent Developments

- In June 2024, Marcin Glogowski, a veteran of PayPal, has been appointed as SVP, Managing Director Europe, and UK CEO of Marqeta. This global modern card issuance platform enables embedded finance solutions for the world’s innovators. He will be in charge of guiding Marqeta throughout the area.

- In February 2024, Introducing Alloy for Embedded Finance, a new product specifically created to help sponsor banks, BaaS providers, and their fintech partners manage identity risk and stay ahead of regulatory requirements cooperatively. Alloy is the identity risk management company that powers nearly 600 top banks and fintech businesses.

Segments Covered in the Report

By Type

- Embedded Payment

- Embedded Insurance

- Embedded Investment

- Embedded Lending

- Embedded Banking

By Business Model

- B2B

- B2C

- B2B2B

- B2B2C

By End-use

- Retail

- Healthcare

- Logistics

- Manufacturing

- Travel & Entertainment

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/