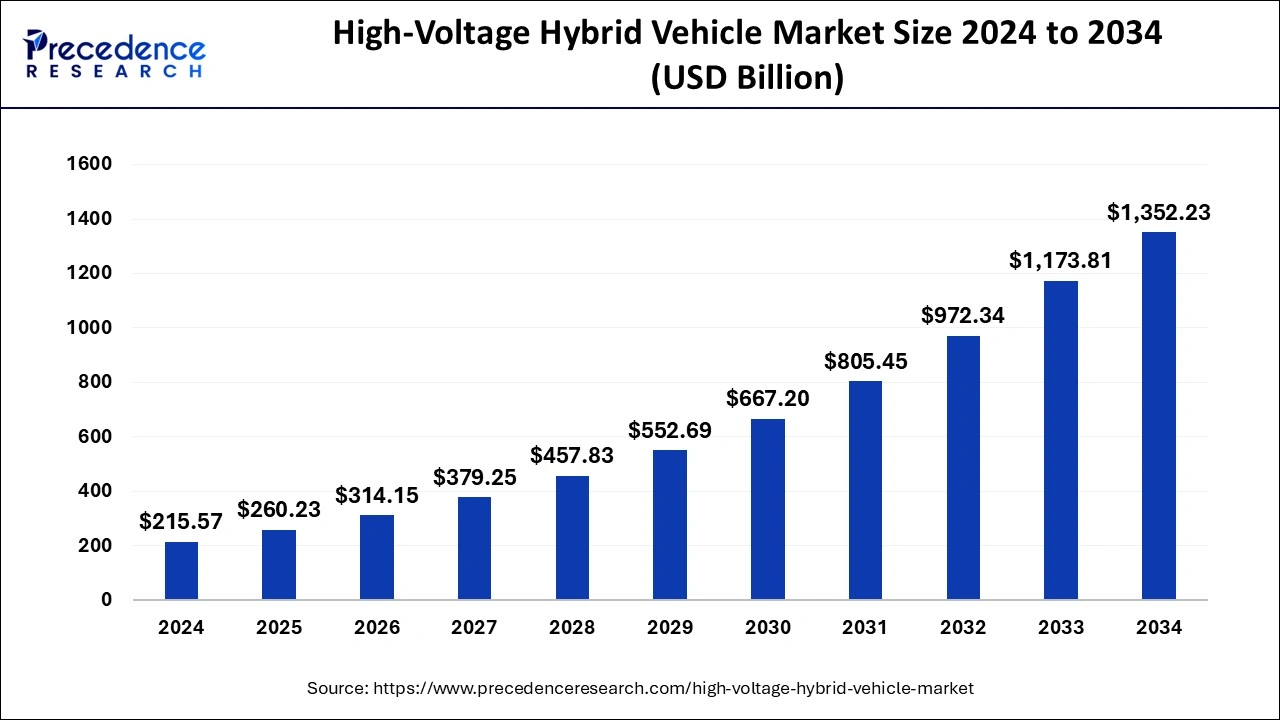

The global high-voltage hybrid vehicle market size was evaluated at USD 178.57 billion by 2023 and is projected to gain around USD 1,173.81 billion by 2033 with a CAGR of 20.72% between 2024 and 2033.

Key Points

- Asia Pacific dominated the high-voltage hybrid vehicle market in 2023.

- North America held a considerable share of the market in 2023.

- By type, the hybrid electric vehicle segment held the largest share of the market in 2023.

- By type, the plug-in hybrid electric vehicle segment will grow rapidly in the market over the forecast period.

- By application, passenger vehicles dominated the market in 2023.

- By application, commercial vehicles segment is expected to show the fastest growth in the market during the forecast period.

Market Overview

The High-Voltage Hybrid Vehicle Market is experiencing significant growth as automotive manufacturers and consumers increasingly focus on sustainable and efficient transportation solutions. High-voltage hybrid vehicles, which combine a traditional internal combustion engine with an electric propulsion system, offer enhanced fuel efficiency, reduced emissions, and improved performance. These vehicles operate on higher voltage systems, typically above 60 volts, allowing for more efficient energy management and greater electric power output. The market encompasses various vehicle types, including passenger cars, commercial vehicles, and specialized transport solutions.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4475

Growth Factors

Several factors contribute to the growth of the high-voltage hybrid vehicle market. Rising environmental concerns and stringent government regulations aimed at reducing greenhouse gas emissions are primary drivers. Governments across the globe are implementing policies and incentives to promote the adoption of hybrid and electric vehicles. Additionally, advancements in battery technology, which enhance energy density and reduce costs, are making high-voltage hybrid vehicles more attractive to consumers. The increasing availability of charging infrastructure also supports market growth by addressing one of the key concerns of potential hybrid vehicle buyers.

High-Voltage Hybrid Vehicle Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 1,173.81 Billion |

| Market Size in 2023 | USD 178.57 Billion |

| Market Size in 2024 | USD 215.57 Billion |

| Market Growth Rate | CAGR of 20.72% from 2024 to 2033 |

| Largest Market | Asia- Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Key drivers of the high-voltage hybrid vehicle market include technological innovations and consumer demand for environmentally friendly vehicles. Automotive manufacturers are investing heavily in research and development to improve the efficiency and performance of high-voltage hybrid systems. The push for fuel economy standards and the rising cost of fossil fuels are prompting consumers to seek alternatives that offer long-term savings. Moreover, the superior performance attributes of high-voltage hybrids, such as better acceleration and smoother driving experience, are appealing to a broad segment of the market.

Opportunities

The high-voltage hybrid vehicle market presents numerous opportunities for growth. Emerging markets, particularly in Asia-Pacific and Latin America, are showing increased interest in hybrid vehicles due to rapid urbanization and rising middle-class incomes. These regions offer significant potential for market expansion. Additionally, continuous advancements in electric powertrain technologies and energy storage solutions can lead to the development of more affordable and efficient high-voltage hybrid models. Partnerships between automotive companies and technology firms can further accelerate innovation and market penetration.

Challenges

Despite its potential, the high-voltage hybrid vehicle market faces several challenges. High initial costs and the complexity of hybrid systems can deter some consumers, particularly in price-sensitive markets. The availability and accessibility of charging infrastructure remain inconsistent across different regions, posing a barrier to widespread adoption. Additionally, the market must contend with the rapid growth of fully electric vehicles, which may overshadow hybrids in the long term as battery technology and charging networks improve.

Region Insights

The high-voltage hybrid vehicle market exhibits varying trends across different regions. In North America and Europe, stringent emissions regulations and strong governmental support for hybrid and electric vehicles are driving market growth. These regions are characterized by a well-developed charging infrastructure and high consumer awareness. In contrast, the Asia-Pacific region, particularly countries like China and Japan, is witnessing rapid growth due to supportive government policies, large population bases, and increasing urbanization. Emerging markets in Latin America and Africa are also showing potential, though growth is slower due to economic constraints and less developed infrastructure. Each region presents unique opportunities and challenges that will shape the future trajectory of the high-voltage hybrid vehicle market.

Read Also: https://www.businesswebwire.com/produced-water-treatment-market/

High-Voltage Hybrid Vehicle Market Companies

- Toyota Motor Corporation

- Honda Motor Co., Ltd

- Ford Motor Company

- General Motors Company

- Hyundai Motor Company

- Kia Corporation

- Volkswagen Group

- BMW Group

Recent Developments

- In March 2024, following the phase-out of the BMW i3, the BMW Group, the forerunner of electric mobility, added another fully electric vehicle to its lineup.

- In April 2024, Chinese automaker BYD may introduce an inexpensive hybrid plug-in sedan to take on the Toyota Corolla in South Africa, as well as its first electric bakkie for the worldwide market. Using the Companies and Intellectual Properties Commission (CIPC) database, My Broadband has discovered two trademark applications submitted by BYD Company Limited in January 2024 for the names under which these cars are anticipated to be sold.

Segment Covered in the Report

By Type

- Prosthetics & Orthodontics

- Endodontics

- Restoratives

- Others

By Application

- Hospital

- Clinic

- Emergency room

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/