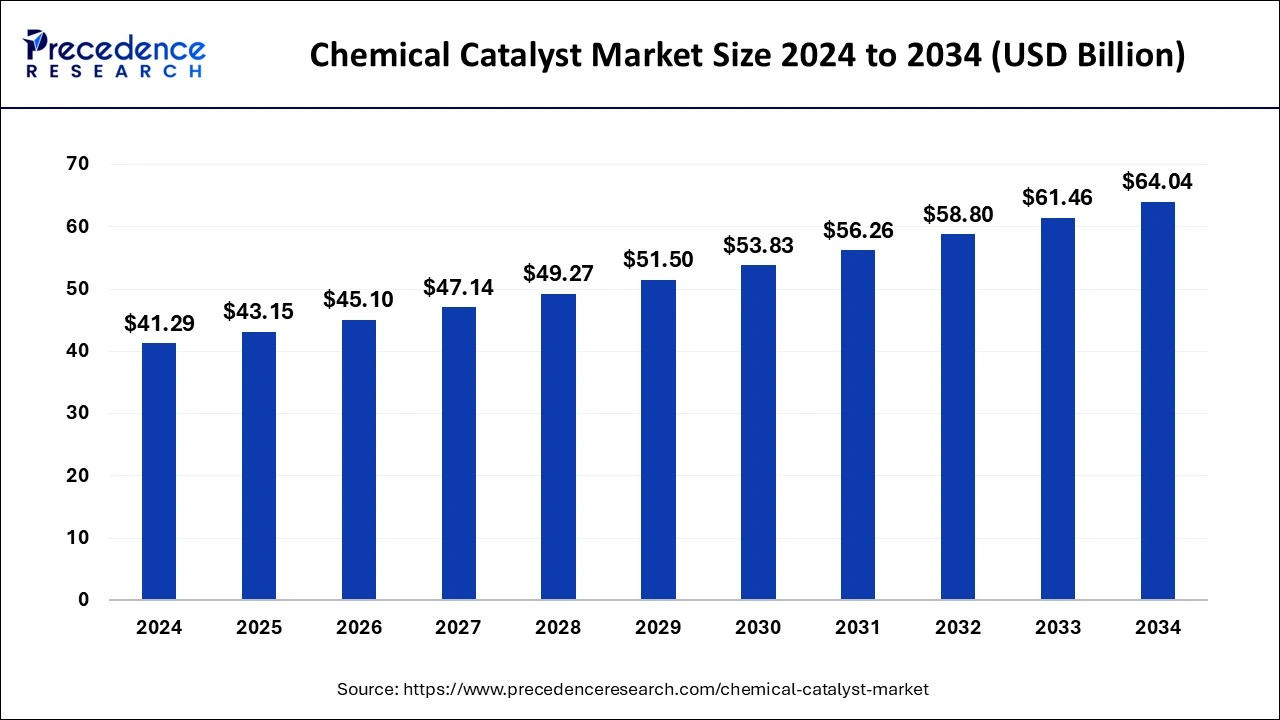

The global chemical catalyst market size was evaluated at USD 39.50 billion by 2023 and is projected to gain around USD 61.46 billion by 2033 with a CAGR of 4.52% between 2024 and 2033.

Key Points

- Asia-Pacific led the market with largest revenue share of 35% in 2023.

- North America is the fastest growing in the market during the forecast period.

- By type, the heterogeneous segment has held a major revenue share of 42% in 2023.

- By type, the homogeneous segment shows a notable growth in the market during the forecast period.

- By material, the metal and metal oxides segment has contributed more than 42%of revenue share in 2023.

- By material, the zeolites segment is the fastest growing in the chemical catalyst market during the forecast period.

- By form, the powder segment dominated the market in 2023.

- By process, the fluid catalytic cracking (FCC) segment dominated the chemical catalyst market.

- By application, the petrochemicals segment dominated the market in 2023.

Market Overview

The chemical catalyst market is a crucial component of the global chemical industry, enabling numerous chemical reactions that are vital for producing a wide range of products. Catalysts are substances that increase the rate of a chemical reaction without being consumed in the process. They are essential in industries such as petrochemicals, pharmaceuticals, polymers, and environmental protection. The market for chemical catalysts is diverse, covering types like zeolites, metals, and enzymes, each with specific applications and benefits. The global chemical catalyst market is expected to witness significant growth, driven by increasing industrialization and the need for more efficient and sustainable chemical processes.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4464

Growth Factors

Several factors contribute to the growth of the chemical catalyst market. One of the primary drivers is the expanding chemical and petrochemical industries, which continuously seek more efficient production methods. Additionally, the rising demand for cleaner fuels and stringent environmental regulations have spurred the development and adoption of advanced catalytic technologies. Innovations in catalyst design and production, aimed at enhancing efficiency and reducing costs, also play a significant role in market growth. Furthermore, the growing focus on sustainable and green chemistry practices encourages the use of catalysts to minimize waste and energy consumption.

Chemical Catalyst Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 39.50 Billion |

| Market Size in 2024 | USD 41.29 Billion |

| Market Size by 2033 | USD 61.46 Billion |

| Market Growth Rate | CAGR of 4.52% from 2024 to 2033 |

| Largest Market | Asia- Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Material, Form, Process, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The main drivers of the chemical catalyst market include the increasing demand for higher productivity in chemical manufacturing and the need to meet stringent environmental regulations. The petrochemical industry, which relies heavily on catalysts for refining processes, continues to grow, boosting the demand for catalysts. Additionally, advancements in catalytic processes for the production of biofuels and other renewable energy sources are driving market expansion. The pharmaceutical industry’s reliance on catalysts for drug synthesis and the growing polymer sector, which uses catalysts for polymerization processes, also contribute significantly to market demand.

Opportunities

The chemical catalyst market presents numerous opportunities, particularly in the development of new and improved catalyst technologies. There is a growing demand for catalysts that can operate efficiently under milder conditions and with greater selectivity, reducing the need for energy-intensive processes and minimizing by-products. Opportunities also exist in the field of biocatalysts, where enzymes are used to facilitate chemical reactions in a more environmentally friendly manner. Additionally, the push towards green chemistry and sustainable practices opens up avenues for catalysts that enable the use of renewable raw materials and the recycling of industrial waste.

Challenges

Despite its growth prospects, the chemical catalyst market faces several challenges. One major challenge is the high cost of catalyst development and production, which can be a barrier for smaller companies and new entrants. The need for continuous innovation to keep up with evolving industrial requirements and environmental standards adds to the complexity and cost. Furthermore, the deactivation and regeneration of catalysts, along with the safe disposal of spent catalysts, pose significant technical and environmental challenges. Market players must also navigate regulatory hurdles and ensure compliance with safety and environmental regulations.

Region Insights

Regionally, the chemical catalyst market exhibits varied dynamics. North America and Europe are mature markets with a strong emphasis on research and development, driven by stringent environmental regulations and advanced industrial bases. The Asia-Pacific region, particularly China and India, is experiencing rapid growth due to increasing industrialization and rising demand for chemicals and petrochemicals. This region is becoming a significant hub for catalyst manufacturing and consumption. In contrast, regions like Latin America and the Middle East & Africa show moderate growth, influenced by their developing industrial sectors and investments in petrochemical and refinery projects. Each region presents unique opportunities and challenges, influenced by local economic conditions, regulatory environments, and industrial growth rates.

Read Also: https://www.businesswebwire.com/peripheral-interventions-market/

Chemical Catalyst Market Companies

- BASF SE

- Clariant AG

- Johnson Matthey PLC

- W. R. Grace & Co.

- Arkema SA

- Royal Dutch Shell PLC

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- DuPont de Nemours, Inc.

- Haldor Topsoe A/S

- Evonik Industries AG

- Sinopec Catalyst Company

Recent Developments

- In April 2024, Clariant, a specialty chemical manufacturer emphasizing sustainability, announced the release of CATOFIN 312, its most recent catalyst for propane dehydrogenation. The new catalyst has a 20% longer life and is more selective.

- In September 2022, BASF unveiled CircleStar, a cutting-edge dehydration catalyst designed to handle sustainable feedstocks. The new star-shaped catalyst converts ethanol to ethylene (E2E) with 99.5% selectivity. CircleStar helps reduce the carbon footprint in the bio-ethylene value chain for products ranging from jet fuel to plastics by more than 10 percent while maintaining the same performance. It works at a temperature over 25°C lower than conventional processes.

Segments Covered in the Report

By Type

- Heterogeneous

- Homogeneous

By Material

- Metal and Metal Oxides

- Zeolites

- Chemical Compound

By Form

- Powder

- Bead

- Extrudate

- Others

By Process

- Fluid Catalytic Cracking (FCC)

- Hydrogenation

- Oxidation

- Isomerization

- Alkylation

- Polymerization

- Others

By Application

- Petrochemicals

- Chemical Synthesis

- Environmental Catalysis

- Polymerization

- Refining

- Pharmaceuticals

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/