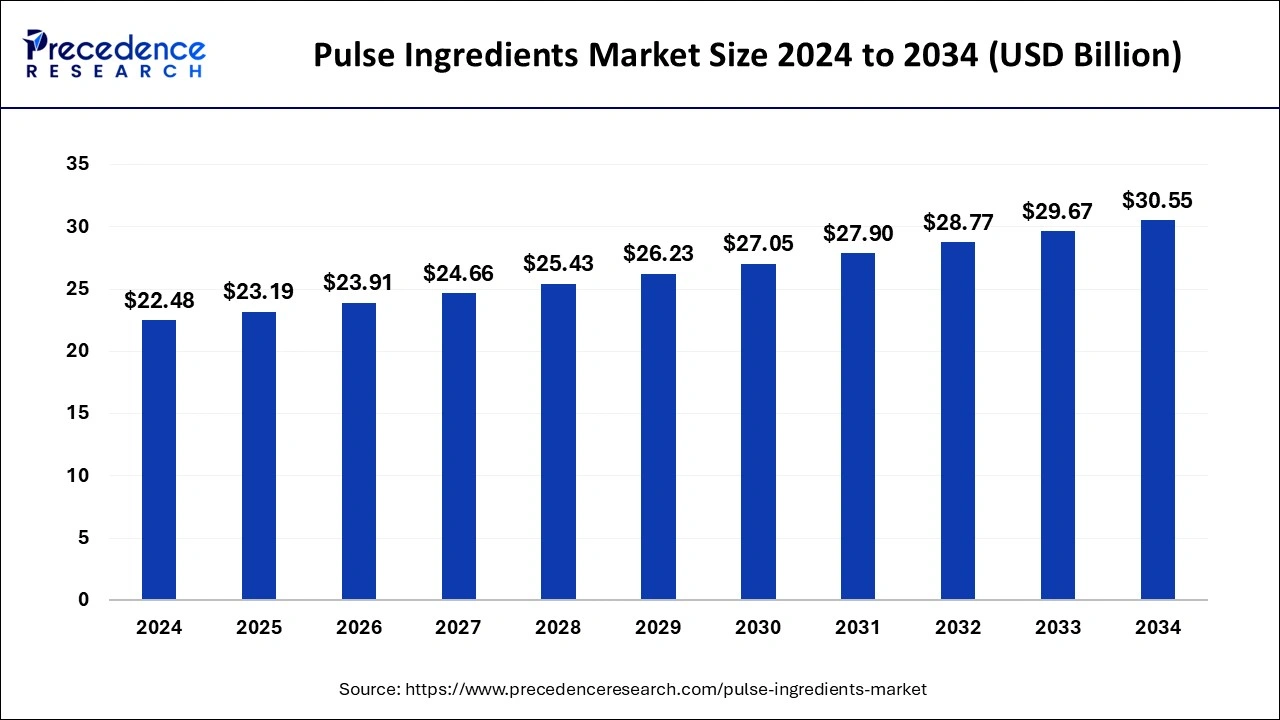

The global pulse ingredients market size was evaluated at USD 21.80 billion by 2023 and is projected to gain around USD 29.67 billion by 2033 with a CAGR of 3.13% between 2024 and 2033.

Pulse Ingredients Market Key Takeaways

- Asia Pacific dominated with the largest revenue share of 34% in 2023.

- By source, the chickpeas segment has held a biggest revenue share of 37% revenue share in 2023.

- By application, the food & beverages segment has held a major revenue share of 45% in 2023.

- By type, the pulse flour segment has contributed more than 36% in 2023.

- By type, the pulse protein segment is expected to grow fastest during the forecast period.

Market Overview

The pulse ingredients market encompasses a variety of products derived from pulses such as lentils, chickpeas, peas, and beans. These ingredients include flours, proteins, fibers, and starches, which are increasingly being incorporated into various food products. The market is witnessing significant growth due to the rising awareness about the health benefits of pulses, their high nutritional content, and the increasing demand for plant-based proteins. Pulses are rich in protein, fiber, vitamins, and minerals, making them an essential part of a balanced diet and a popular choice for health-conscious consumers and the food industry.

Get Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4454

Growth Factors

Several factors contribute to the growth of the pulse ingredients market. The increasing consumer inclination towards plant-based and gluten-free diets is a primary driver. Additionally, pulses are recognized for their low glycemic index and ability to support heart health, weight management, and digestive health, which further boosts their popularity. The growing food and beverage industry, coupled with the trend of incorporating healthier ingredients into processed foods, also propels market growth. Innovations in food technology and the development of new products and applications for pulse ingredients are expanding their use across various sectors.

Pulse Ingredients Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 21.80 Billion |

| Market Size in 2024 | USD 22.48 Billion |

| Market Size by 2033 | USD 29.67 Billion |

| Market Growth Rate | CAGR of 3.13% from 2024 to 2033 |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Source, Application, Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The primary drivers of the pulse ingredients market include the rising health awareness among consumers and the increasing prevalence of lifestyle-related diseases, which prompt a shift towards healthier dietary options. The demand for sustainable and environmentally friendly food sources also drives the market, as pulse crops have a lower environmental footprint compared to animal-based proteins. The expanding vegan and vegetarian population and the growing demand for organic and natural food products are other significant drivers. Furthermore, supportive government policies and initiatives promoting pulse cultivation and consumption enhance market growth.

Opportunities

The pulse ingredients market presents several opportunities for growth and expansion. The increasing popularity of plant-based diets creates a vast market potential for pulse-based products. Innovations in food processing and ingredient technology offer opportunities to develop new and improved pulse ingredients with enhanced functional properties. The expanding applications of pulse ingredients in non-food sectors, such as pet food and animal feed, present additional growth avenues. Moreover, the growing trend of clean label products and the demand for natural and minimally processed ingredients provide opportunities for manufacturers to cater to the evolving consumer preferences.

Challenges

Despite the promising growth prospects, the pulse ingredients market faces several challenges. The fluctuating prices of raw pulses due to varying agricultural yields and climatic conditions can affect the cost and supply of pulse ingredients. The presence of anti-nutritional factors in pulses, such as phytic acid and lectins, can impact their nutritional quality and digestibility, posing a challenge for their use in food products. Additionally, the lack of awareness and limited consumer knowledge about the benefits of pulse ingredients can hinder market growth. Overcoming these challenges requires investment in research and development, consumer education, and the development of efficient supply chain mechanisms.

Region Insights

The pulse ingredients market exhibits varied growth patterns across different regions. North America and Europe are key markets due to the high demand for plant-based foods and the strong presence of health-conscious consumers. The increasing trend of veganism and vegetarianism in these regions further drives the market. Asia-Pacific is expected to witness significant growth due to the high production and consumption of pulses in countries like India, China, and Australia. The rising disposable incomes and growing health awareness among consumers in this region also contribute to market expansion. Latin America and the Middle East & Africa regions are gradually emerging as potential markets due to increasing urbanization and changing dietary habits.

Read Also: https://www.businesswebwire.com/healthcare-interoperability-solutions-market/

Recent Developments

- In February 2024, Protein Industries Canada declared that it will be investing in the development of novel ingredients and consumer food choices. As part of the experiment, Big Mountain Foods, Danone Canada, and Old Dutch will substitute several conventional ingredients and processing aids in their respective products with novel oat and pulse ingredients developed by Avena Foods. As a result, customers will have access to additional options, such as allergy-friendly substitutes.

- In January 2024, The National Agricultural Cooperative Marketing Federation of India and the National Cooperative Consumers’ Federation of India (NCCF) will be able to buy tur dal (pigeon pea) directly from registered farmers thanks to a portal that the Indian government launched in an effort to make the country’s pulse supply self-sufficient. The Indian Home Minister opened the webpage. It will make it easier to register, buy, and pay farmers directly for their Tur Dal. He added that India won’t need to import any pulses by January 2028.

- In June 2023, Banza announced the launch of frozen waffles made with chickpeas.

- In June 2023, Kraft Heinz announced the introduction of chickpea-based vegan cheese slices. The business and AI brand NotCo have teamed to introduce a line of vegan cheese slices.

Pulse Ingredients Market Companies

- Roquette Freres

- ADM

- Emsland Group

- The Scoular Company

- Anchor Ingredients

- Batory Foods

- Dakota Ingredients

- Cargill

- Diefenbaker Spice & Pulse

- Cosucra

- Vestkorn

- AM Nutrition

- Avena Foods

- HUA THAI

- Aminola

- Herba Ingredients

- NutriPea

- Ebro Ingredients

- Ingredion Inc.

- Emsland Group

- Coscura; Puris

- Axiom Foods, Inc.

- AGT Food & Ingredients

Segments Covered in the Report

By Source

- Lentils

- Peas

- Chickpeas

- Beans

By Application

- Food & Beverage

- Feed

- Others

By Type

- Pulse Flour

- Pulse Starch

- Pulse Protein

- Pulse Fiber & Grits

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/