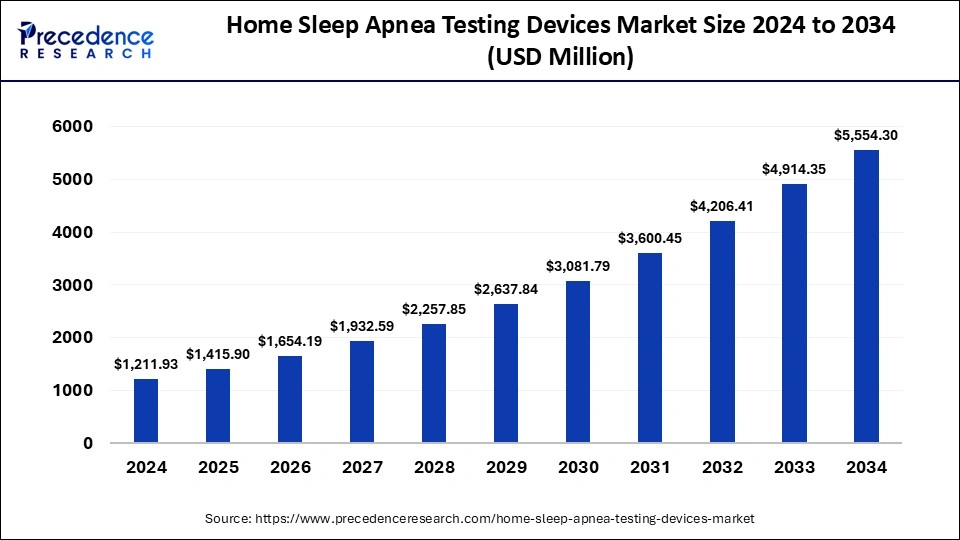

The global home sleep apnea testing devices market size surpassed USD 1,037.34 million in 2023 and is predicted to reach around USD 4,914.35 million by 2033 with a CAGR of 16.83% from 2024 to 2033.

Key Points

- The North America home sleep apnea testing devices market size accounted for USD 352.70 million in 2023 and is expected to attain around USD 1,695.45 million by 2033, poised to grow at a CAGR of 17% between 2024 and 2033.

- North America has held a major revenue share of 34% in 2023.

- Asia Pacific is projected to experience the fastest growth in the market during the forecast period.

- By type, the type 3 segment dominated the market with the largest revenue share of 72% in 2023.

- By type, the type 4 segment is expected to witness the fastest growth in the market during the forecast period.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/4426

Market Overview

The Home Sleep Apnea Testing (HSAT) devices market encompasses a range of diagnostic tools designed for the at-home detection and monitoring of sleep apnea. These devices offer an accessible, convenient, and cost-effective alternative to traditional in-lab polysomnography, enabling patients to undergo sleep testing in the comfort of their own homes. HSAT devices typically include sensors and monitors that record data on breathing patterns, oxygen levels, heart rate, and other physiological parameters during sleep. The market has seen significant growth due to increasing awareness of sleep apnea and its health implications, technological advancements, and the rising demand for remote healthcare solutions.

Growth Factors

Several factors are driving the growth of the HSAT devices market. First, there is a growing prevalence of sleep disorders, particularly obstructive sleep apnea (OSA), fueled by rising obesity rates and an aging population. Second, advancements in wearable technology and sensor accuracy have improved the reliability and user-friendliness of HSAT devices. Third, healthcare policies and insurance coverage are increasingly supporting home-based diagnostics as a cost-effective alternative to hospital-based sleep studies. Finally, the COVID-19 pandemic has accelerated the adoption of telehealth and remote monitoring solutions, further boosting the demand for HSAT devices.

Home Sleep Apnea Testing Devices Market Scope

| Report Coverage | Details |

| Home Sleep Apnea Testing Devices Market Size in 2023 | USD 1,037.34 Million |

| Home Sleep Apnea Testing Devices Market Size in 2024 | USD 1,211.93 Million |

| Home Sleep Apnea Testing Devices Market Size by 2033 | USD 4,914.35 Million |

| Home Sleep Apnea Testing Devices Market Growth Rate | CAGR of 16.83% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Key drivers for the HSAT devices market include the rising prevalence of sleep apnea and related health conditions, such as cardiovascular diseases and diabetes, which necessitate early diagnosis and management. Technological advancements in portable diagnostic devices, including improved sensors, wireless connectivity, and data integration with telehealth platforms, are also critical drivers. Additionally, increasing patient preference for convenient, at-home testing solutions and supportive healthcare policies that promote home-based diagnostics over expensive in-lab tests are significant factors boosting market growth.

Opportunities

The HSAT devices market presents several growth opportunities. Integration with digital health platforms and mobile applications can enhance patient engagement and provide real-time data to healthcare providers, improving diagnosis and treatment plans. Expansion into emerging markets with large, underserved populations and increasing disposable incomes offers significant potential for market players. Collaborations between device manufacturers and telehealth companies can facilitate comprehensive sleep health solutions. Moreover, ongoing research and development in biometrics and artificial intelligence can lead to the next generation of HSAT devices with enhanced accuracy and predictive capabilities.

Challenges

Despite the promising growth, the HSAT devices market faces several challenges. The accuracy and reliability of home-based testing compared to traditional polysomnography remain a concern, necessitating continuous innovation and validation of these devices. Regulatory hurdles and varying standards across different regions can complicate market entry and expansion. Additionally, limited awareness and acceptance of HSAT devices among patients and healthcare providers in certain regions can hinder market growth. Finally, ensuring data privacy and security in remote monitoring systems is a critical challenge that needs to be addressed to gain consumer trust.

Region Insights

The HSAT devices market exhibits significant regional variation. North America dominates the market, driven by high awareness of sleep disorders, advanced healthcare infrastructure, and favorable reimbursement policies. Europe follows closely, with strong growth in countries like Germany and the UK, where public health initiatives and technological adoption are robust. In the Asia-Pacific region, rapid economic development, increasing healthcare expenditure, and rising awareness of sleep health contribute to market expansion. Countries like China, Japan, and India are witnessing substantial growth, although the market is still in its nascent stages compared to Western regions. Latin America and the Middle East & Africa regions are gradually emerging, with growth propelled by urbanization and improving healthcare access.

Read Also: https://www.businesswebwire.com/endoscope-reprocessing-market/

Home Sleep Apnea Testing Devices Market Companies

- Fisher & Paykel Healthcare

- ImThera Medical, Inc.

- Natus Medical, Inc.

- Somnetics International, Inc.

- Braebon Medical Corporation

- BMC Medical Co., Ltd.

- Teleflex, Inc.

- Weinmann Medical Devices GmbH & Co., KG.

- Philips Respironics

- CareFusion Corp.

- Compumedics Limited

- and Nihon Kohden.

Recent Developments

- In February 2023, Philips Respironics introduced the release of its new domestic sleep screening tool, the Philips DreamMapper Pro. The DreamMapper Pro is a software platform that may be used to tune and control sleep apnea remedies.

- In March 2023, SomnoMed introduced the release of its new domestic sleep screening tool, the SomnoMed AXG300. The AXG300 is a wi-fi device that can be used to diagnose sleep apnea and loud night breathing.

- In April 2023, Welch Allyn introduced the release of its new domestic sleep screening tool, the Welch Allyn SleepCheck Pro. The SleepCheck Pro is a fingertip pulse oximeter that may be used to screen blood oxygen degrees all through sleep.

- In November 2022, ResMed and Alphabet’s life science offshoot Verily announced the formation of Primasun, an end-to-end solution to help employers and healthcare providers identify populations at risk for complex sleep disorders.

- In October 2022, Airway Management, manufacturer of the most globally researched custom oral appliances, announced the launch of flexTAP, a premium lab-made oral appliance designed to treat patients with snoring and mild to moderate obstructive sleep apnea.

Segments Covered in the Report

By Test Type

- Type 2

- Type 3

- Type 4

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/